(Please be aware: you may not see all these updates, depending on your subscription. For more information, please reach out to your sales contact.)

Content Additions and Changes

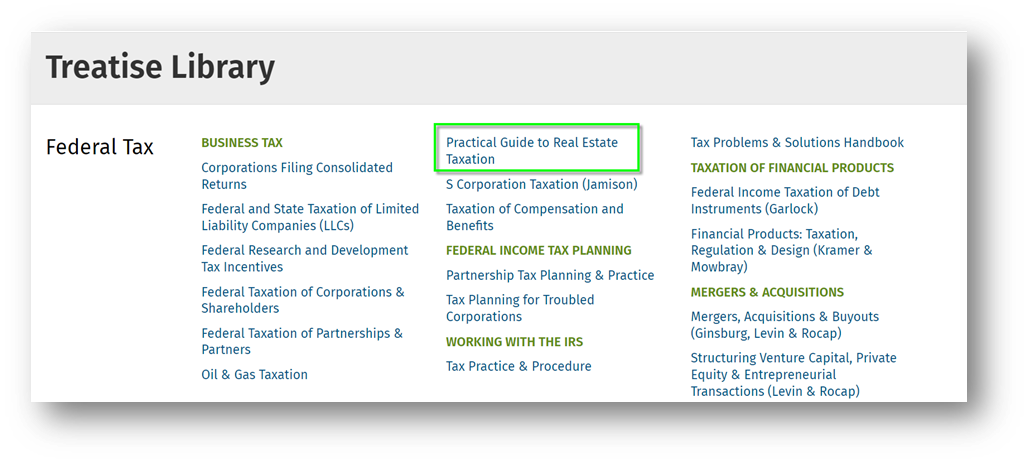

Treatise: Practical Guide to Real Estate Taxation

We’ve added the Practical Guide to Real Estate Taxation, by David F. Windish. The guide provides insight into the taxation of real estate and covers the tax consequences and foundations of real estate investment, operations, activities, and more.

To access the treatise, click Treatises on the Home page and scroll to the Federal Tax section.

Treatise: Investment Planning Answer Book

We’ve added the Investment Planning Answer Book, by Jay L. Shein.

The book focuses on advising clients on the available investment options at various stages of life and income level. It covers investment tools, devising a portfolio strategy, asset allocation methodology, and measurement of return and risk allocation. This title will be of interest to accountants, financial planners, and trustees. Whether seeking to adjust a portfolio or developing an all-new financial plan, Investment Planning Answer Book will provide CPAs, financial planners, and trustees with practical information to assist clients in achieving their financial goals.

To access the treatise, click Treatises on the Home page and scroll to the Financial and Estate Planning section.

Treatise: Taxation of Individual Retirement Accounts

We’ve added the Taxation of Individual Retirement Accounts treatise, by David J. Cartano.

The treatise provides comprehensive analysis of the tax laws applicable to individual retirement accounts including the different types of IRAs, such as the Roth IRA, education IRA, SIMPLE IRA, and the deemed IRA. It discusses the various areas of tax law relating to the operation and administration of an IRA and then deals with taxation of distributions from an IRA.

To access the treatise, click Treatises on the Home page and scroll to the Financial and Estate Planning section.

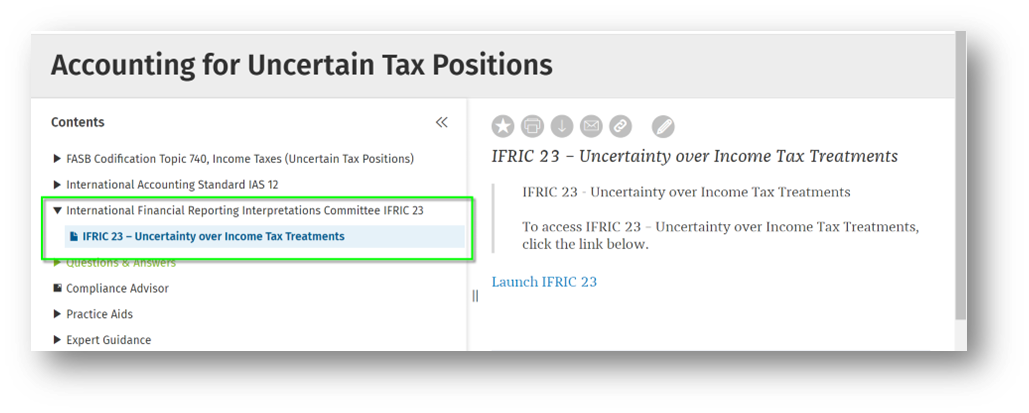

Accounting for Uncertain Tax Positions

We added IFRIC 23 to Accounting for Uncertain Tax Positions.

You’ll find this content on the Federal Home tab under Specialty Areas.