(Please be aware: you may not see all of these updates, depending on your subscription. For more information, reach out to your sales contact.)

Access Critical Coronavirus (COVID-19) Resources

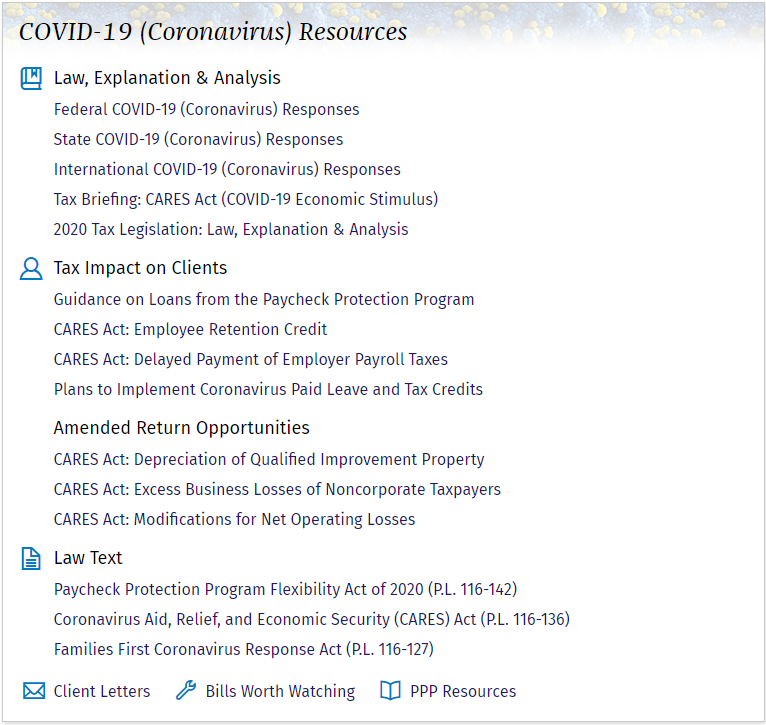

We are continuing to update our COVID-19 resources to help keep you informed. Links to this content are available in the COVID-19 resource center on the CCH AnswerConnect Home Page. Here you will find the relevant topic pages, tax impacts for your clients, and any related law text. Additionally we have created quick links to the most relevant tools to understand the changes.

In addition, we have provided all Federal regulations to the wider public. As federal agencies create guidance for any of the tax and compliance changes, and we are sharing this information with everyone.

To ensure that you have the best tools, we are also giving every customer access to CCH AnswerConnect Client Impact events through mid-August 2020! Located under Tax News on the home page, Client Impact events allow you to quickly offer customized action plans for your clients. To see the breadth of Topics covered you can find these events here.

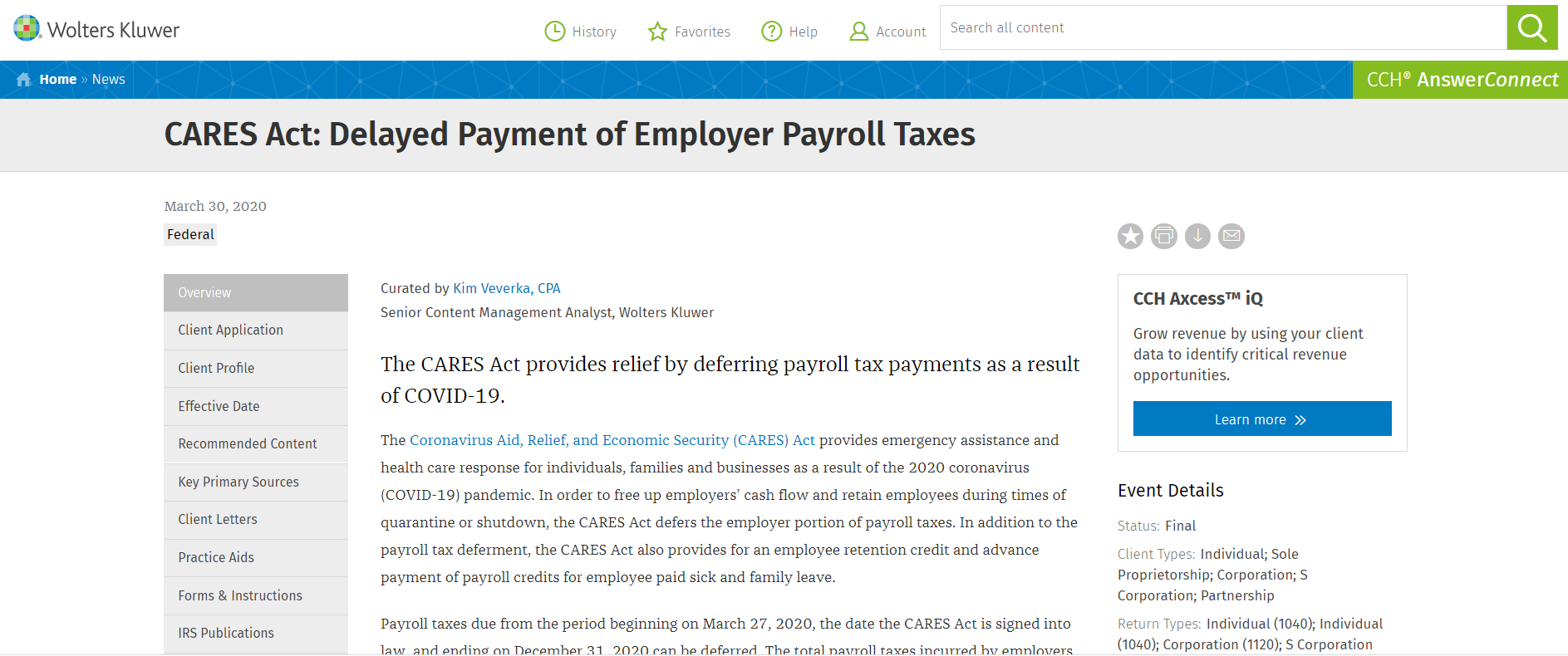

Each Client Impact article offers a complete toolkit to assist your clients or business. Take a look at this Client Impact event: Cares Act: Delayed Payment of Employer Payroll Taxes.

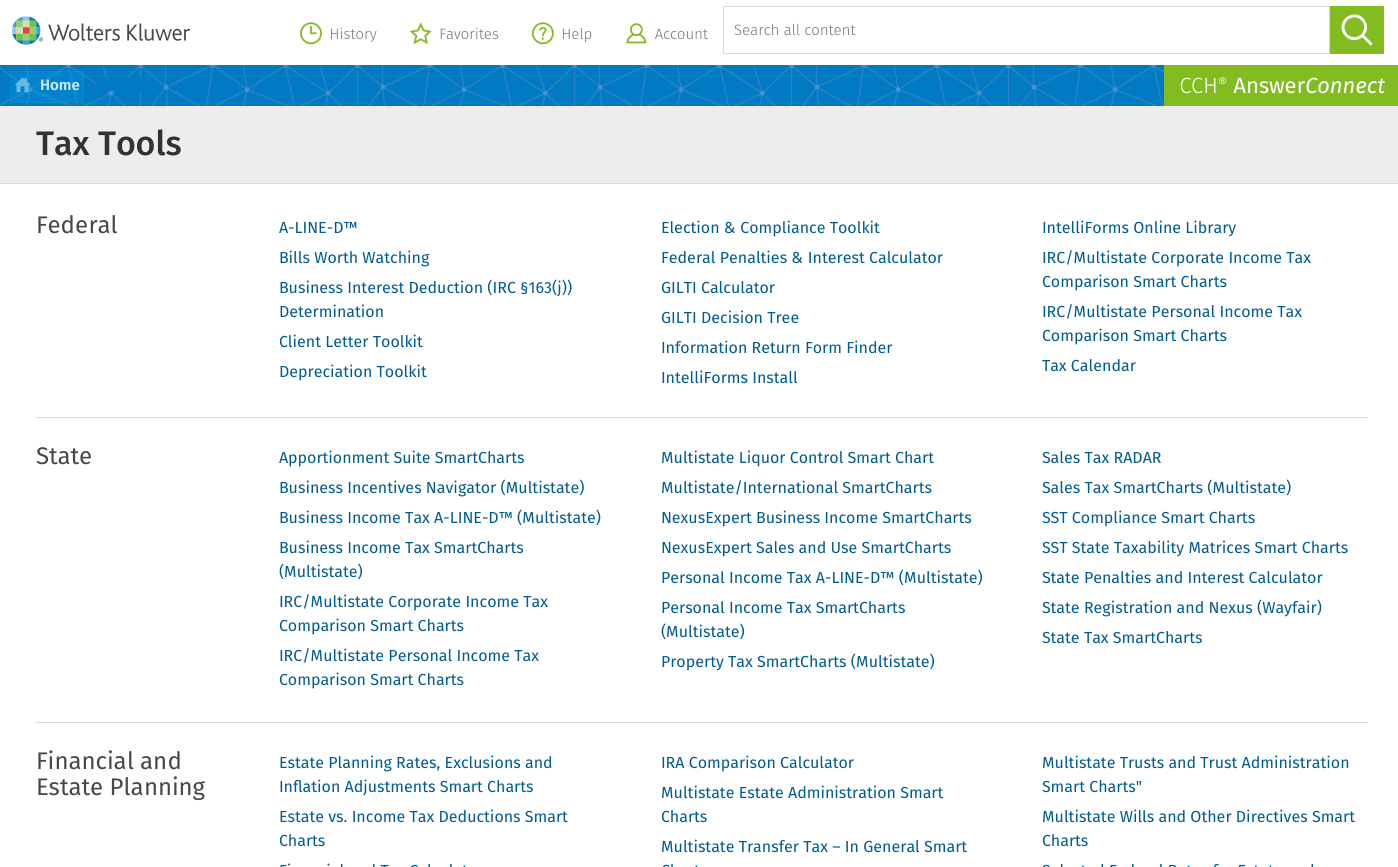

Improved Tax Tools listing

We’ve streamlined the display of the Tools listing page to make it easier to scan and find what you are looking for.

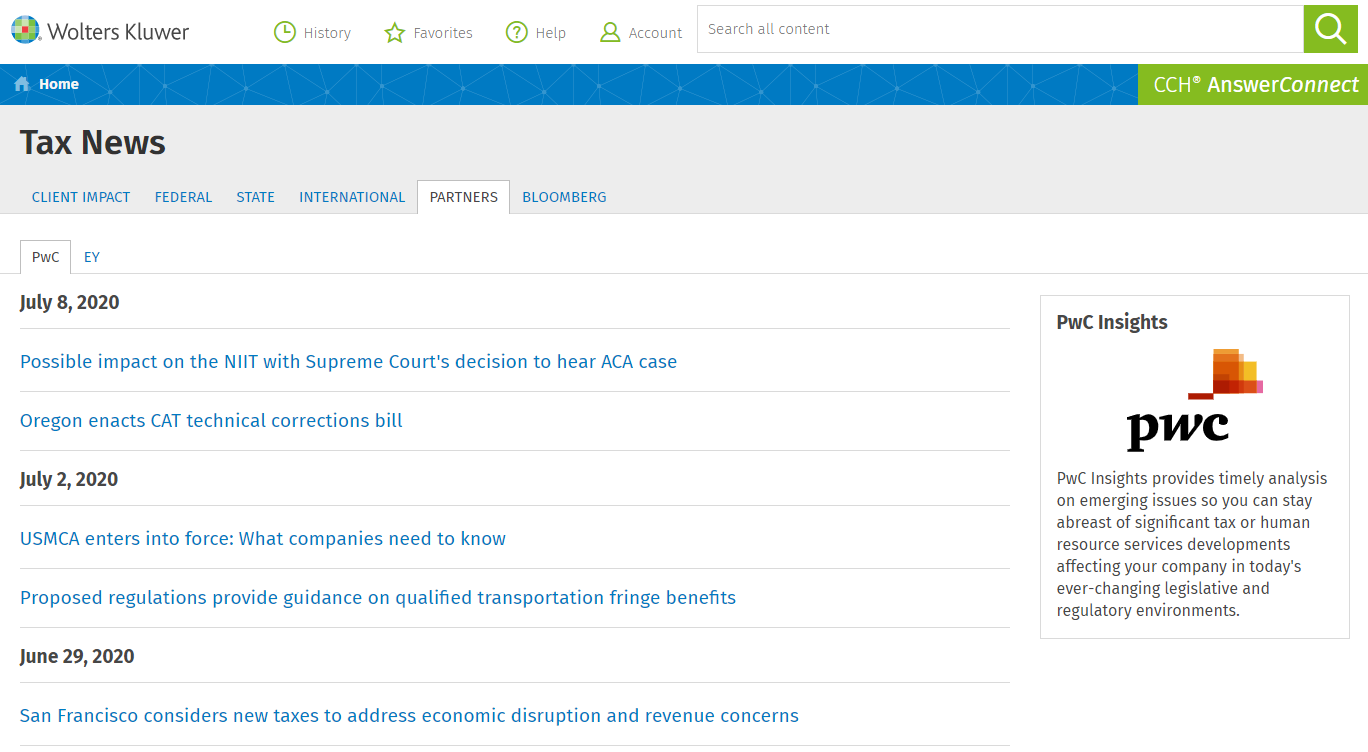

PwC Insights & EY Tax Alerts

Looking for the latest news? Find it on CCH AnswerConnect! World renowned authors from both EY and PwC cover many current issues and topics that you can find within one easy-to-search platform.

Setup an email alert on CCH AnswerConnect to have this content delivered to your inbox.

New Content Sets

New Topics

CCH AnswerConnect provides you with the most comprehensive, in-depth coverage of Federal, State & International tax topics. These new topics were added in this release:

New Federal Topics

- Substantiating Business Expenses

- Requirements for Substantiating Business Expenses

- Employee Accountable and Nonaccountable Reimbursement Plans

- Substantiation by Reimbursement Arrangements, Per Diem, or Mileage and Other Traveling Allowances

- Depletion Deduction

- Economic Interest Requirement for Depletion

- Cost Depletion

- Percentage Depletion in General

- Percentage Depletion Rates

- Percentage Depletion for Independent Producers and Royalty Owners

- Percentage Depletion Gross Income Computation

- Documentation for Payee Status

- Depositing Taxes Withheld on Foreign Persons

- Section 199A Deduction Combined Qualified Business Income: REIT Dividends and PTP Income

- Corporate Reorganizations: Bankrupt or Insolvent Corporation (Type G)

- Adjusted Gross Income

- COVID-19 (Coronavirus) Tax Relief: Self-Employment Credits for Sick and Family Leave

- Military Service Members

- Unemployed Taxpayers

- Bottom Dollar Payment Obligations

New State Topic

- Estate, Inheritance, and Gift Taxes (State Tax)

Financial & Estate Planning Practice Tools

In addition to the updated look, we added a section for these new resources in the Tools listing page.

- Financial and Tax Calculators

- IRA Comparison Calculator

- Multistate Estate Administration Smart Charts

- Multistate Transfer Tax Rates Smart Charts

- Multistate Trusts and Trust Administration Smart Charts

- Multistate Wills and Other Directives Smart Charts

Multistate Inheritance, Estate & Gift

Expanding the current inheritance, estate, and gift content, we have added a new Topic covering Estate, Inheritance, and Gift Taxes (State Tax), two new Smart Charts: Multistate Transfer Tax – In General and Multistate Transfer Tax Rates, and many primary sources.

Puerto Rico Primary Sources

CCH AnswerConnect now allows you to access the Puerto Rico Statutes, Regulations, Forms & Other Practice Aids, and Rulings.

Bloomberg Federal, State & International Tax Portfolios

Access Bloomberg Tax and CCH content through CCH AnswerConnect directly. We have made it easier for you to search and find this content through one integrated search platform! You can now add Bloomberg Daily Tax Report to your CCH AnswerConnect tax news email alert.

Multistate Tax Guide to Pass-Through Entities

An authoritative practice-tested reference tool for accountants, corporate tax departments, and other practitioners who need accurate, timely information concerning the operation of multistate or single-state S corporations, partnerships, limited liability companies, and limited liability partnerships in all 50 states.

Tax Problems & Solutions Handbook

Working with the IRS can be complicated and frustrating – even for the most knowledgeable tax professional. The rules in resolving tax problems often appear unclear and they change often, leaving tax professionals and taxpayers with no line-of-sight to resolving their tax problems. The Handbook provides the most current practical know-how to convey that line-of-sight.

Payroll Federal & State

CCH AnswerConnect continues to include more content designed for specific needs. We’ve added a new Specialty tab in search results so that you can access this specialized content easily. Search for this content through CCH AnswerConnect and access it on Cheetah.

Coming Soon

We are working hard to make finding the critical tax information you need as easy as possible. This new redesign of the Tax Prep Partner series allows you to easily scan and browse this content by Form and topic. A link to this new browse approach will be available from the home page and from Search!

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.