(Please be aware: you may not see all these updates, depending on your subscription. For more information, please reach out to your sales contact.)

Content Additions and Changes

International Tax

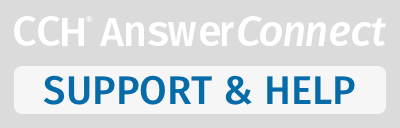

BEPS Pillar Two Guidance & Tools

Monitor the latest developments related to the implementation of global minimum tax.

To access OECD Pillar Two guidance and implementation Smart Charts, go to the International Tax Home page, under Emerging Issues & Tax Reform.

Federal Tax

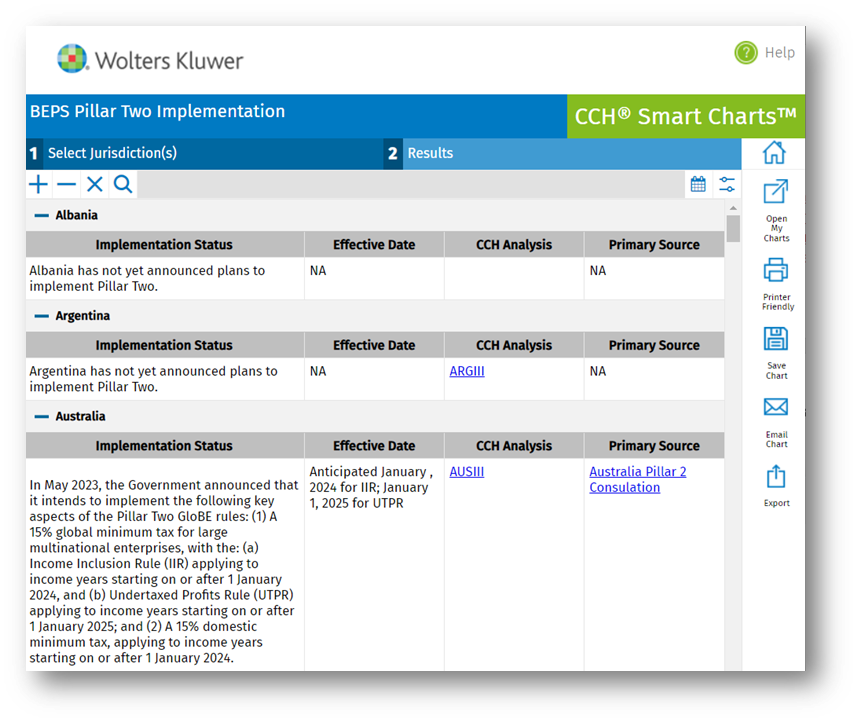

Internal Revenue Code Archives

Quickly find a snapshot of Internal Revenue Code sections in effect for prior years. Whether you need support for an audit or examination, are amending a return, or are doing other historical research, easily access archived versions back to 1913.

To access the archives, from the Home page, click Federal Tax Archives and then select the Internal Revenue Code option.

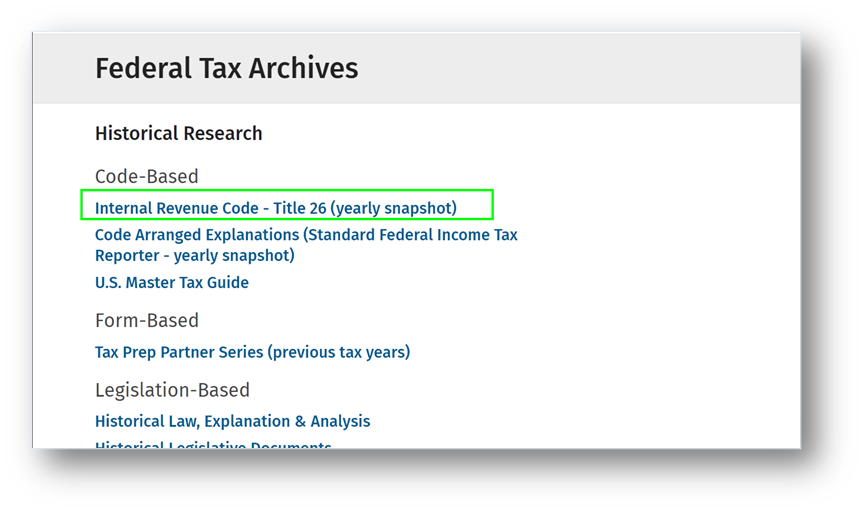

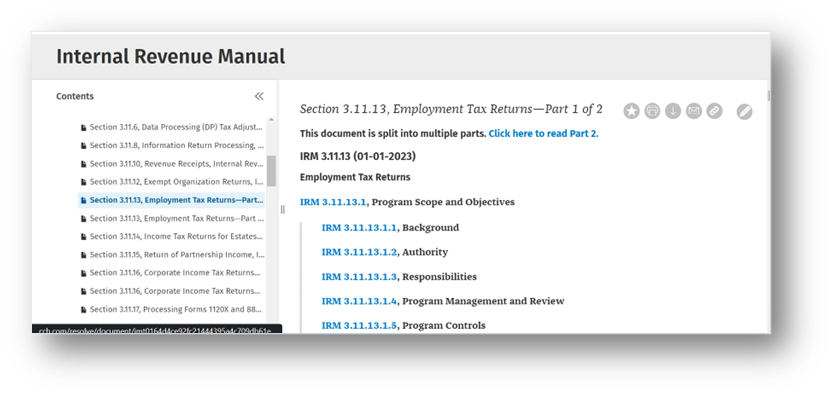

Internal Revenue Manual – Now Browsable

You can now browse the Internal Revenue Manual.

To access the browsable Internal Revenue Manual, from the Home page, click All Federal Tax and then select the Internal Revenue Manual option.

New Federal Tax Tools

CCH AnswerConnect provides easily accessible, action-oriented practice tools to assist you every step of the way in your tax research and planning. In the Tax Tools listing under Federal Tax, you’ll find new workflow tools covering:

- Creditability of Foreign Income Tax

- Determination of U.S. Shareholder and CFC Status

- Inherited IRA Required Minimum Distributions