(Please be aware: you may not see all of these updates, depending on your subscription. For more information, reach out to your sales contact.)

New COVID-19 Tools

We are pleased to be able to add three new tools to our COVID-19 (Coronavirus) Resources to help you better estimate payroll tax credits.

- COVID-19 Employee Retention Credit Estimator

- COVID-19 Paid Sick Leave Credit & Family Leave Credit Estimator

- Coronavirus (COVID-19) Pandemic Filing/Payment Relief Smart Chart is a quick lookup chart for state tax filings and payment responses to COVID-19

CCH AnswerConnect Tools Listing

International Content Additions

International Tax Planning and Wealth Management: New International Low-Tax Jurisdiction Topics & guides covering 26 low tax regions

These topic pages include comprehensive, up-to-date information on jurisdictions that offer competitive tax regimes. You’ll find topics on:

Business Formation

- Country Overview (Low-tax Jurisdictions)

- Companies (Low-tax Jurisdictions)

- Financial Institutions (Low-tax Jurisdictions)

- Partnerships and Limited Partnerships (Low-tax jurisdictions)

- Trusts (Low-tax Jurisdictions)

- Other Special Entities (Low-tax Jurisdictions)

- Establishment of International Insurance Companies (Low-tax Jurisdictions)

Corporate Income Tax

- Taxation System (Low-tax Jurisdictions)

- Taxation of Foreign Income (Low-tax Jurisdictions)

- Non-residents and Non-resident Offshore Companies (Low-tax Jurisdictions)

- Non-residents and Non-resident Offshore Trusts (Low-tax Jurisdictions)

- Non-residents and Non-resident Offshore Partnerships (Low-tax Jurisdictions)

- Non-resident Offshore Special Entities (Low-tax Jurisdictions)

- Tax Treaty Arrangements (Low-tax Jurisdictions)

Tax Planning

- Tax Planning Toolkit (Low-tax Jurisdictions)

Treatises

The following international tax planning treatises are also now available on CCH AnswerConnect.

- Guide to Global REIT

- International Trust Laws & Analysis

International Home Page

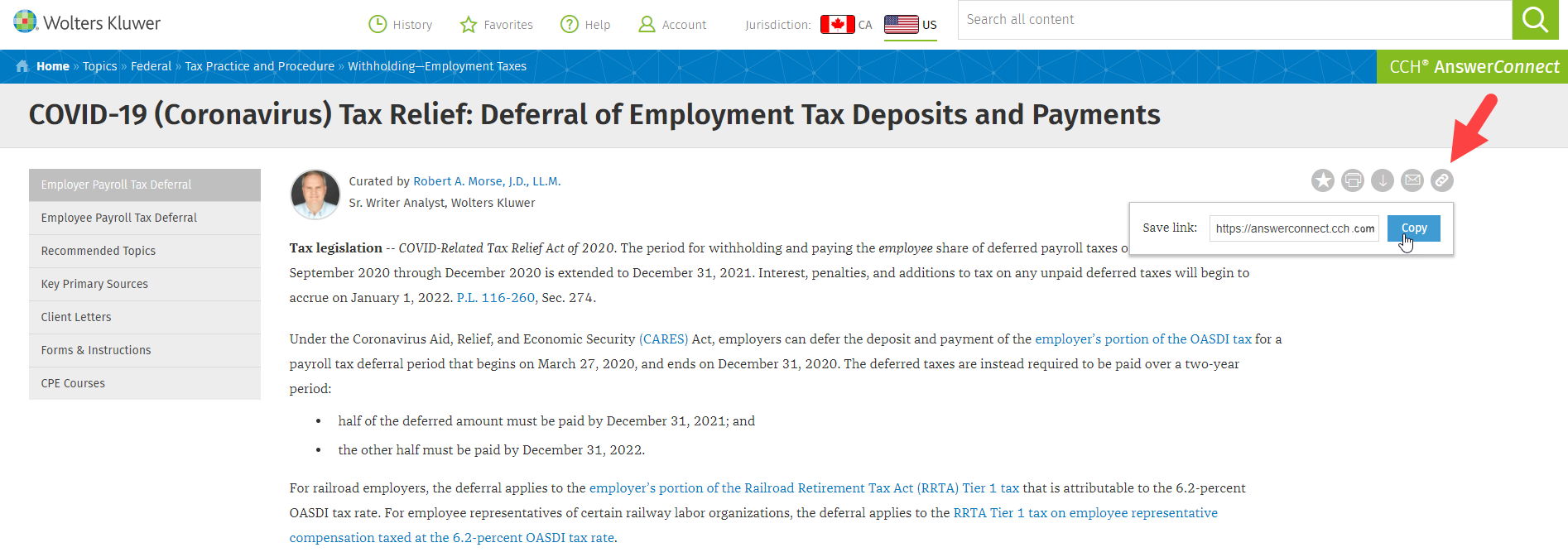

New – Easy Copy Links Option

Find a document you want to share or bookmark? Use the new Copy document link to reference, bookmark, or share the document using the link icon that appears at the top of every document. You can then paste the URL anywhere to share the document.

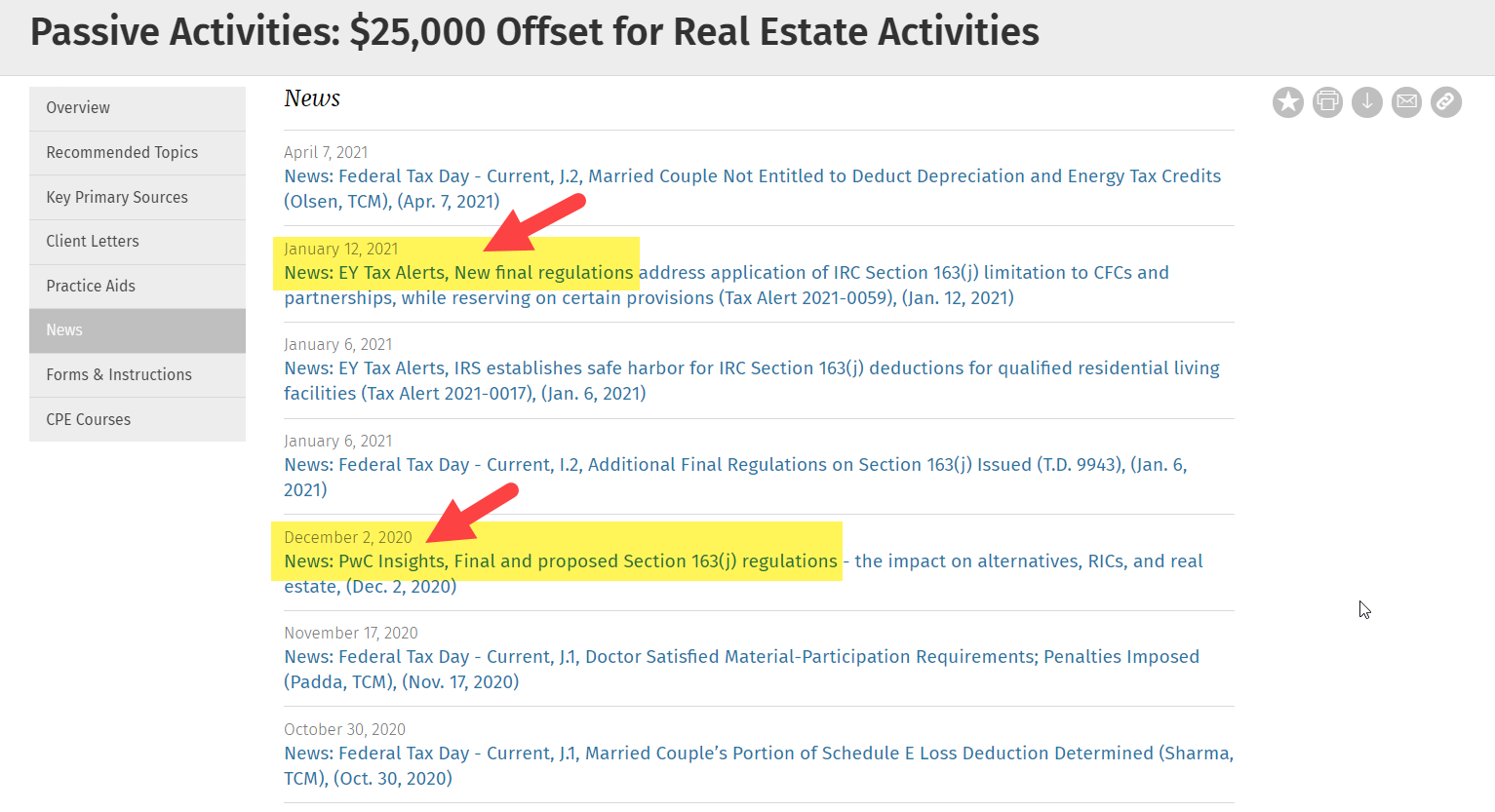

PwC Insights & EY Alerts in Topics

To provide further guidance in our topics on new tax developments, we have added PwC Insights & EY Alerts right within the topic within the News section. This additional new source provides an additional perspective on the news item.

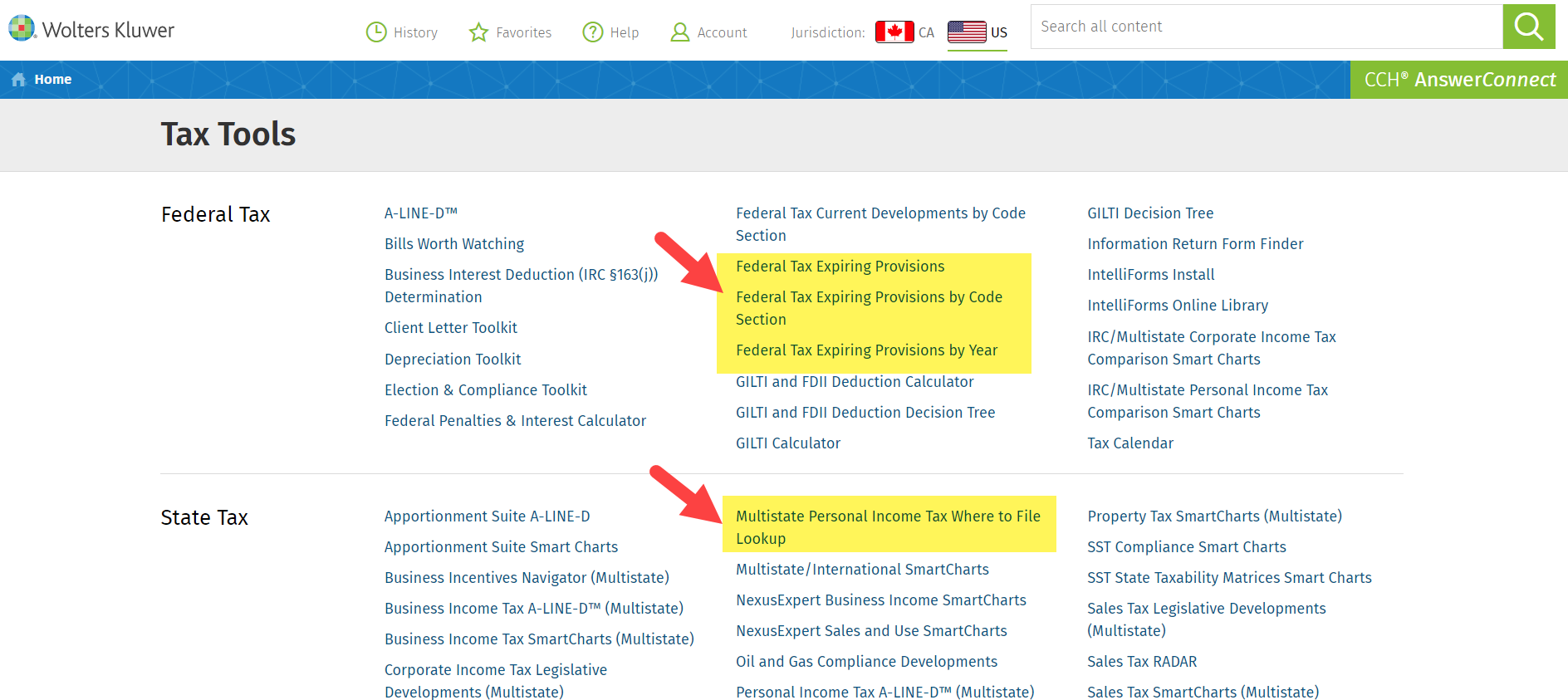

New Federal and Multistate Tools

Federal Tax Expiring Provisions are key as you manage your clients or your firm’s business. To that end, we have added new Federal Tax and Multistate tax tools and charts. You can find these either on the Tools listing page as well as via search.

- Federal Tax Expiring Provisions

- Federal Tax Expiring Provisions by Code Section

- Federal Tax Expiring Provisions by Year

- Multistate Personal Income Tax Where to File lookup

Tools Listing

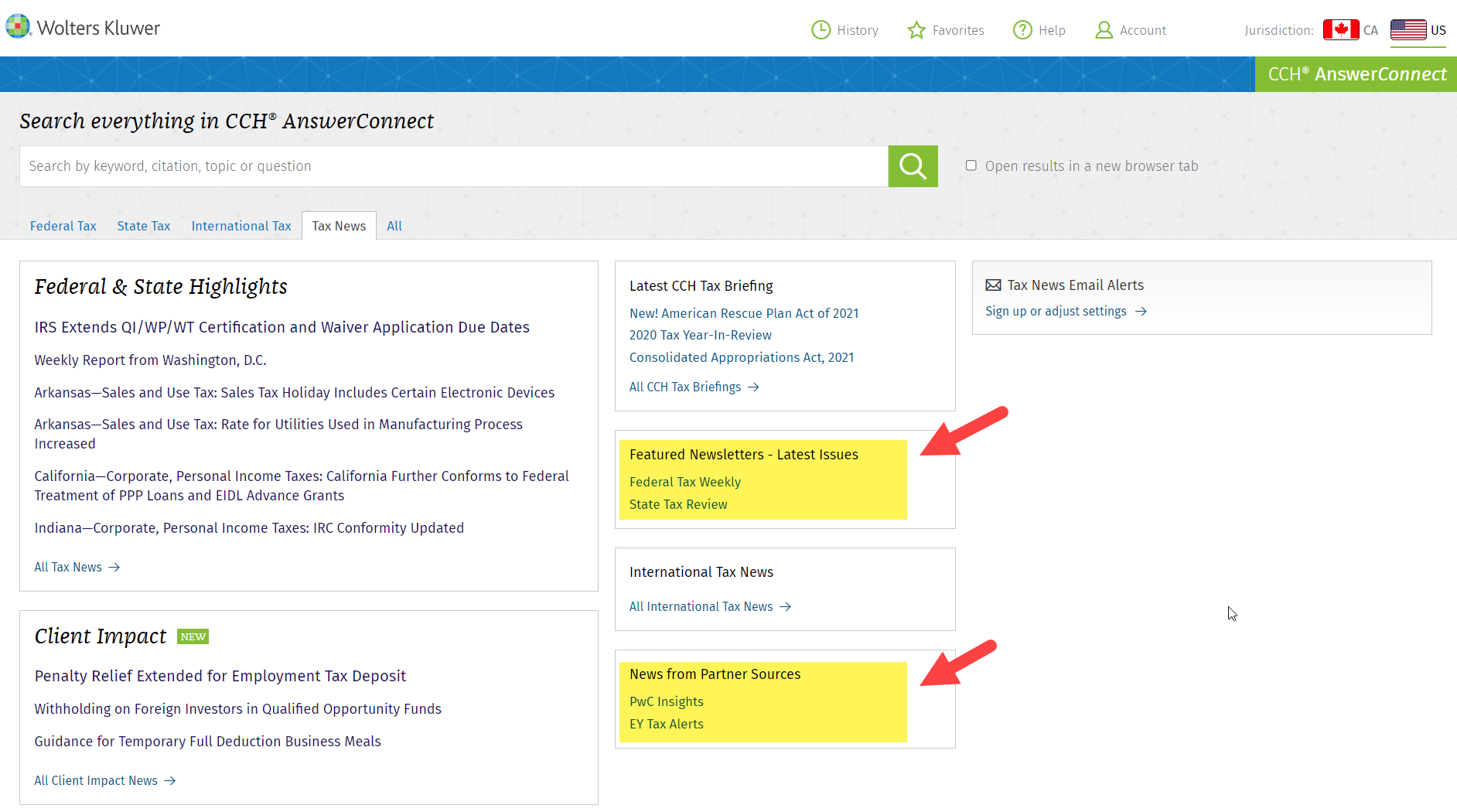

Tax News Additions

We’ve added these handy new links to the Tax News tab home page:

Featured Newsletters

Quick access to the latest issues of our popular newsletters:

- Federal Tax Weekly

- State Tax Review

News from Partner Sources

- PwC Insights

- EY Tax Alerts

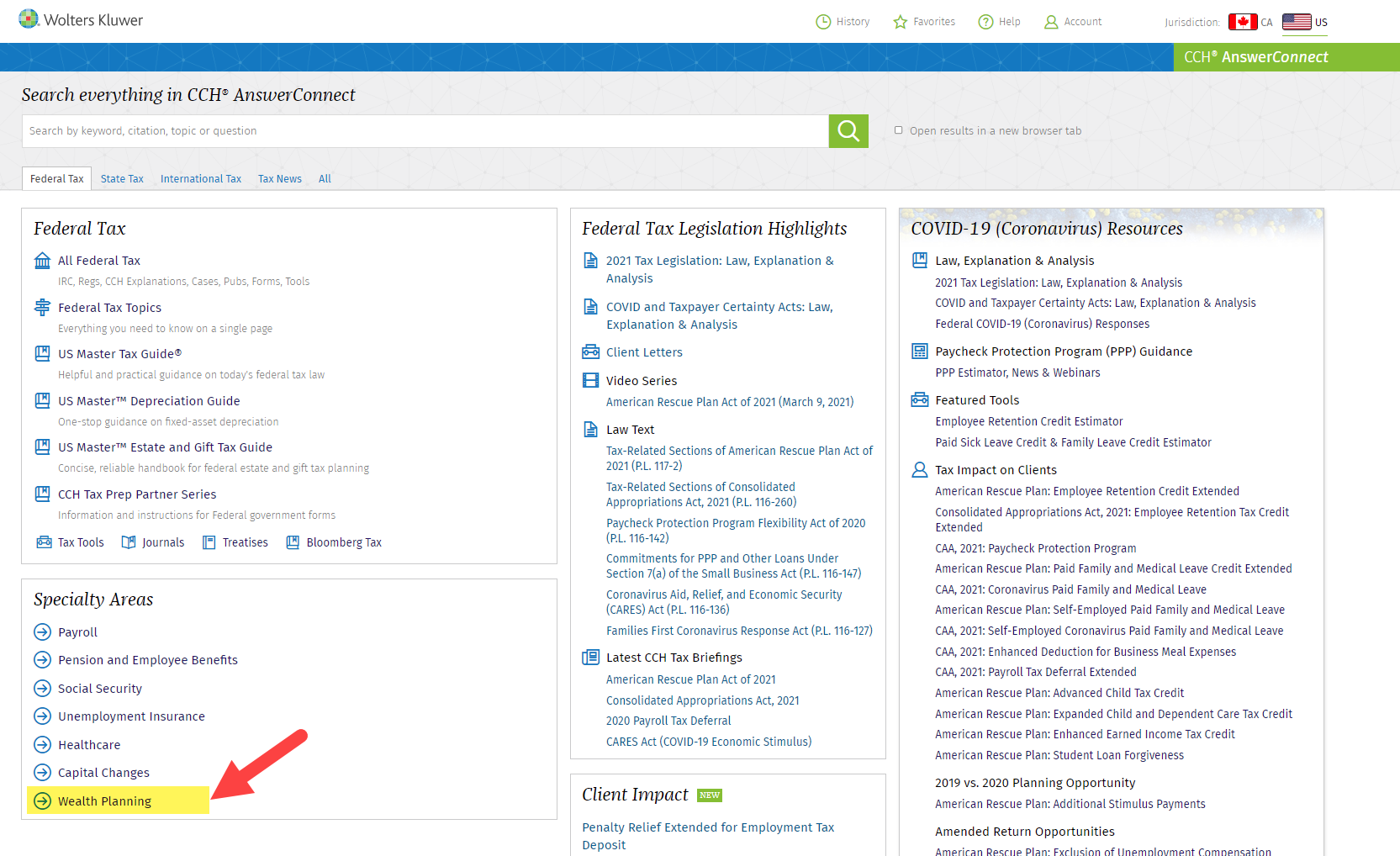

Browse & Search Wealth Planning

- If you subscribe to additional content on Wealth Planning and Executive Compensation, you’ll now be able to link directly to this content on the Cheetah research platform. You can also search for this content right on CCH AnswerConnect.

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.