(Please be aware: you may not see all these updates, depending on your subscription. For more information, please reach out to your sales contact.)

Offer High-Value Advisory Services

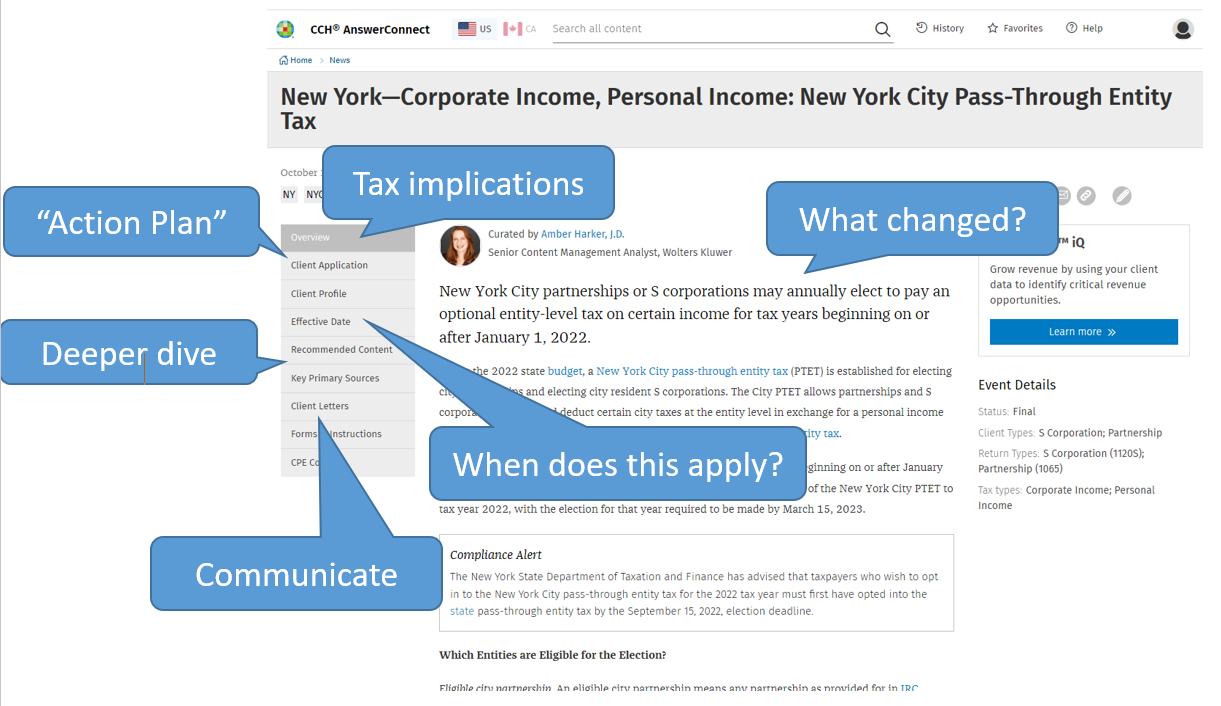

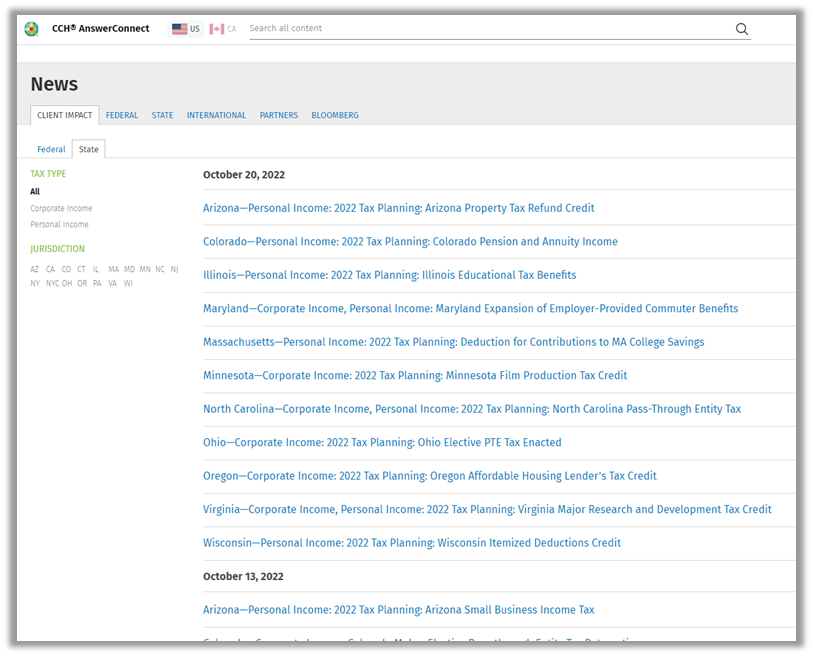

State tax events and tax planning opportunities are available in Client Impact, on CCH AnswerConnect. Whether you are with a corporate tax department or accounting firm, use State Tax Client Impact to drive growth.

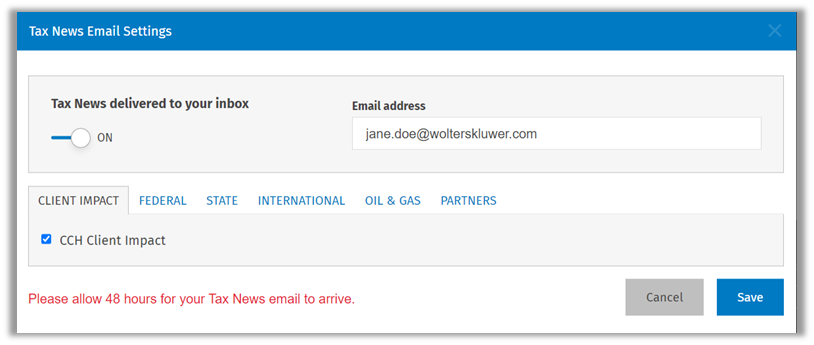

Receive alerts on actionable state tax changes.

Understand tax implications, and gain efficiencies with everything you need in one place.

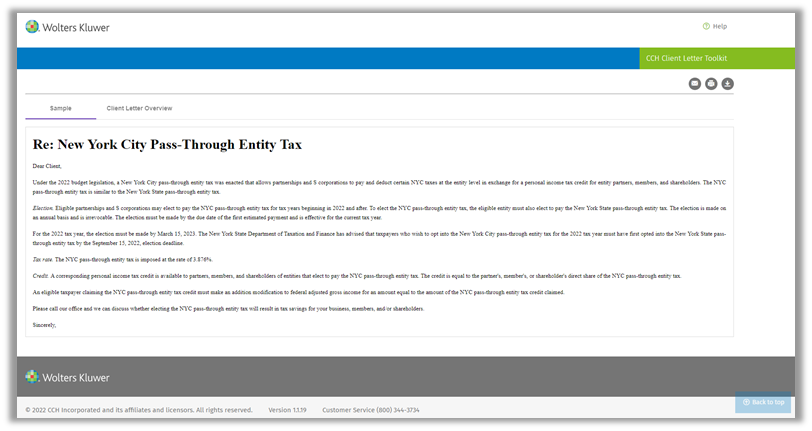

Start a dialog with clients or business stakeholders, using the pre-written letter. Follow-up, to discuss tax strategies and savings opportunities.

Firms:

- Increase client engagement, retention and spend

- Expand advisory services

- Support tax strategies and plan next steps, with our expert analysis

- Improve firm marketing – cover state tax changes on social media, firm’s website, newsletters

Businesses:

- Reduce risk, by understanding tax implications of state tax changes

- Identify tax planning opportunities to save the business money

- Be proactive – write an internal memo using the pre-written letter, to start a dialog with business stakeholders

- Use our expert analysis to support tax strategies and plan next steps

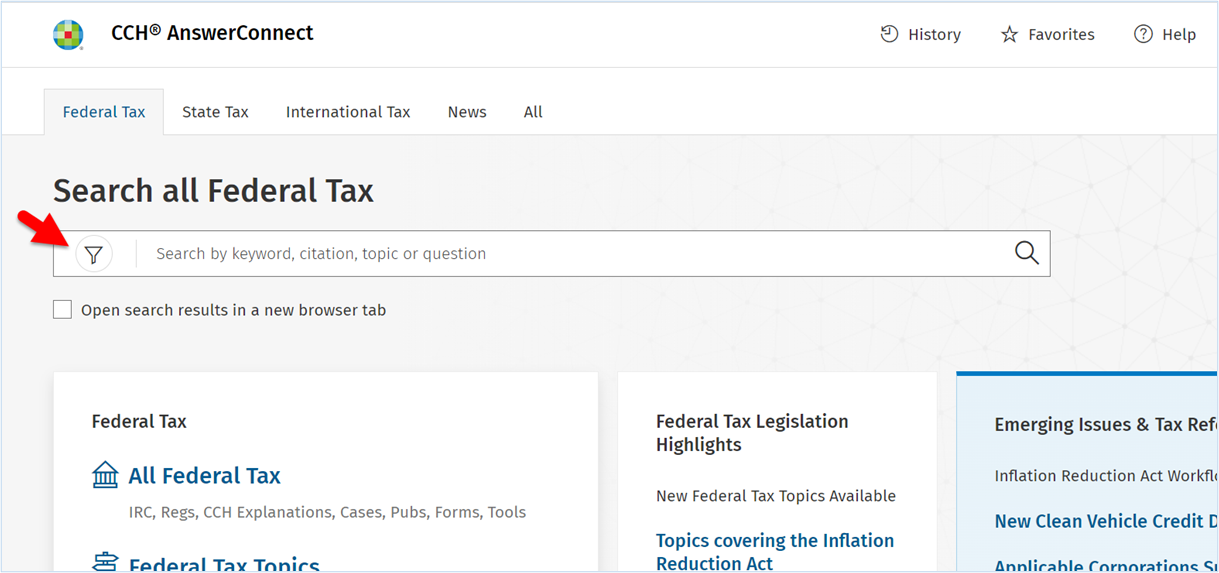

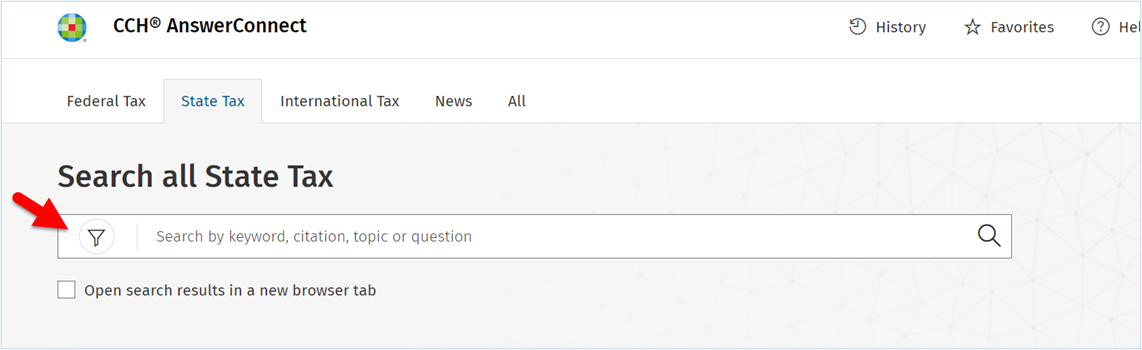

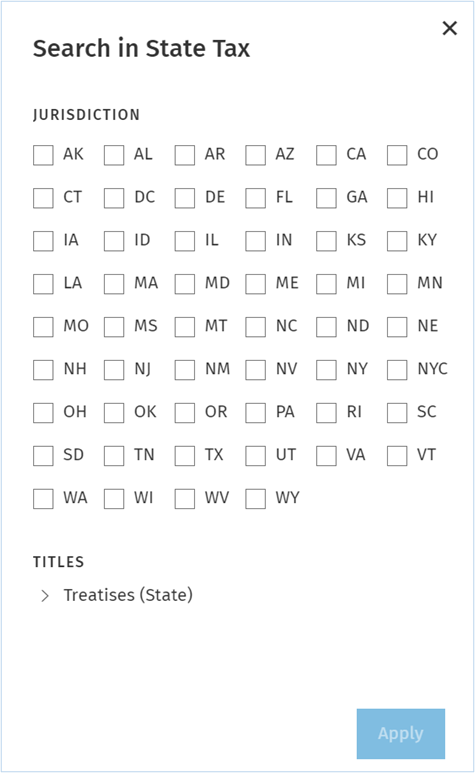

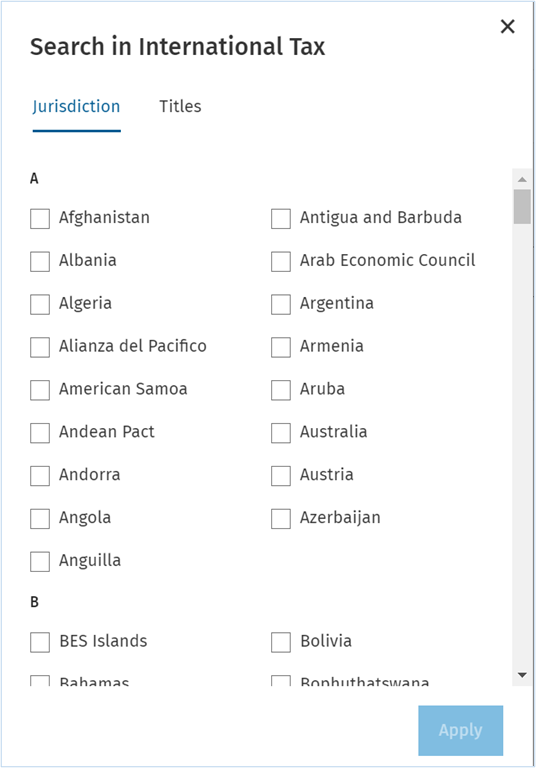

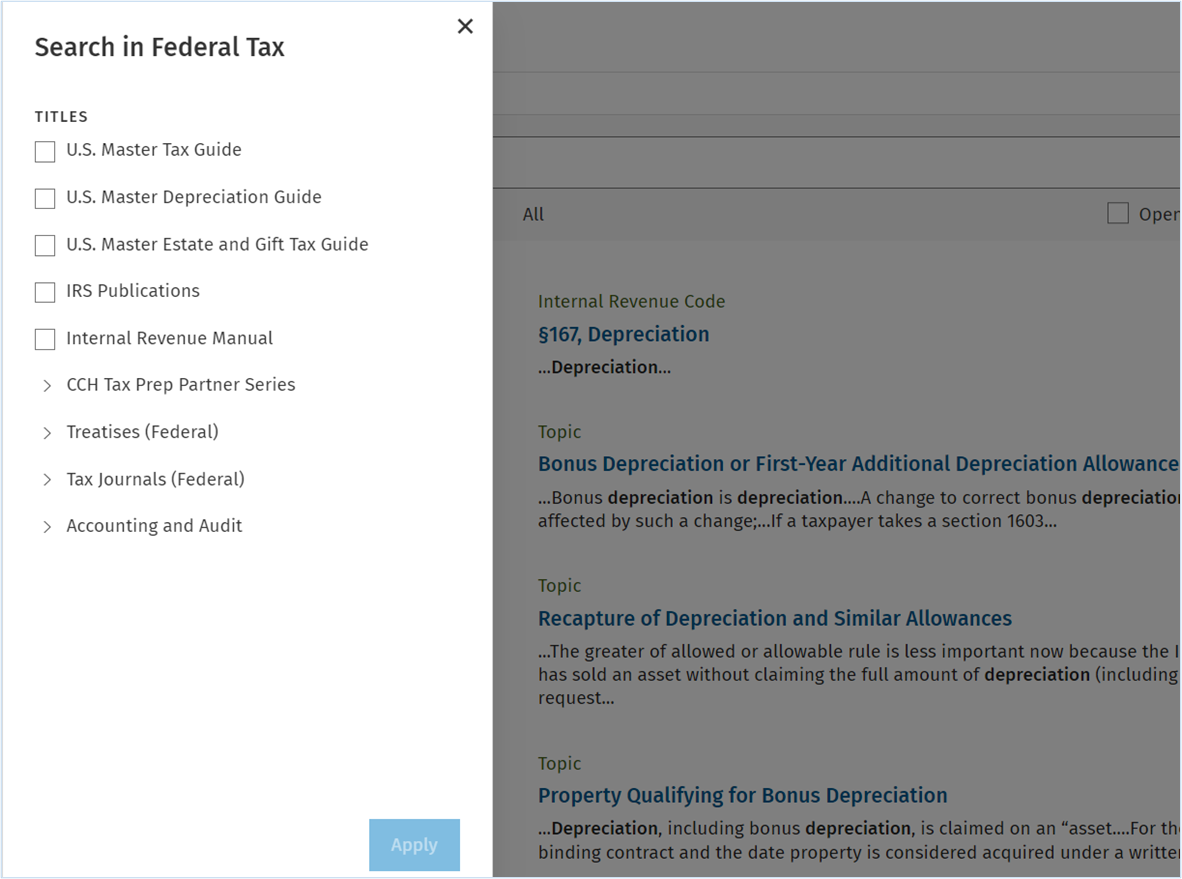

Target Content & Jurisdictions to Search

Target specific content, or jurisdictions, before you run a search. It’s a handy way to pre-filter your results.

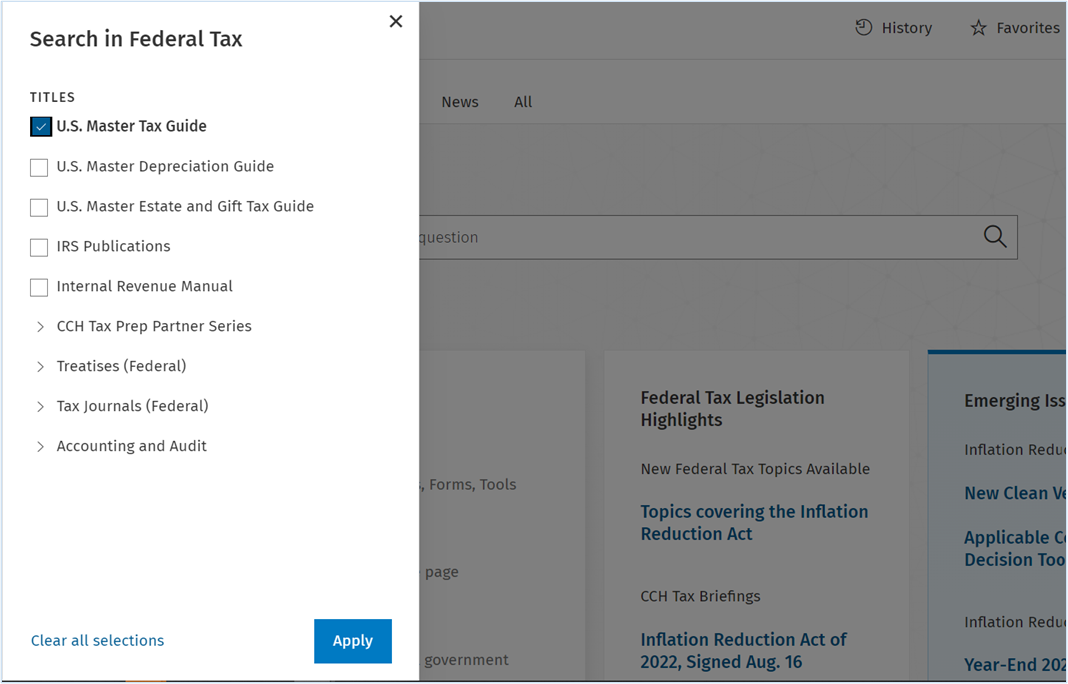

Click the filter icon on the search box to see the items you can target.

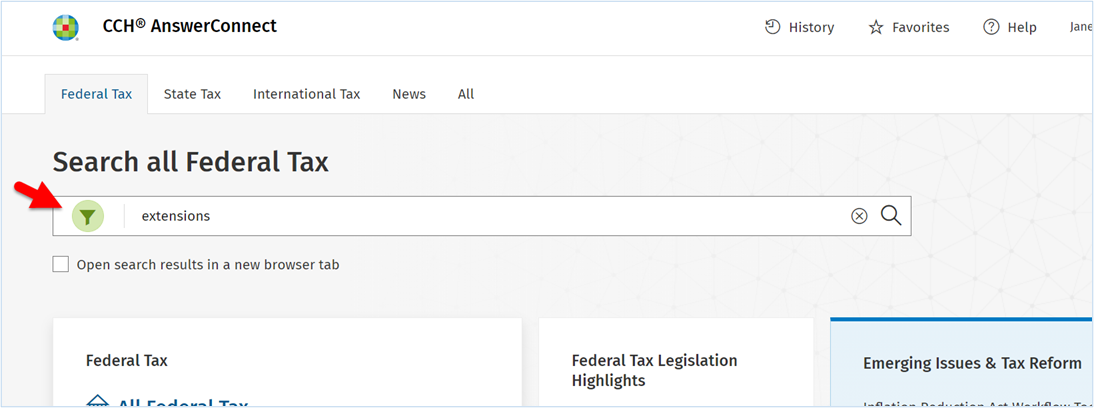

Select and apply your targets.

Notice the filter icon is shaded green – you can run the search.

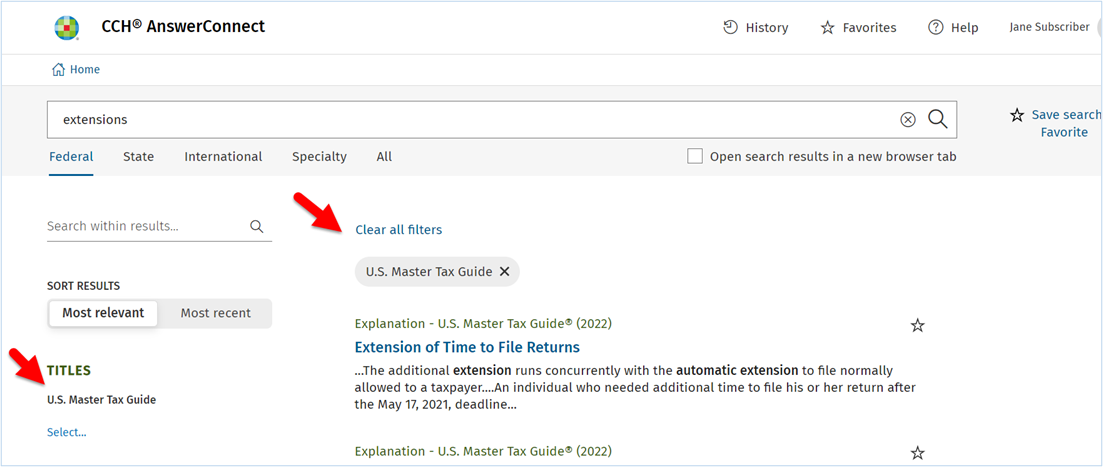

Results are shown with your filters applied.

Depending on your subscription, you can also target jurisdictions to easily pinpoint search results.

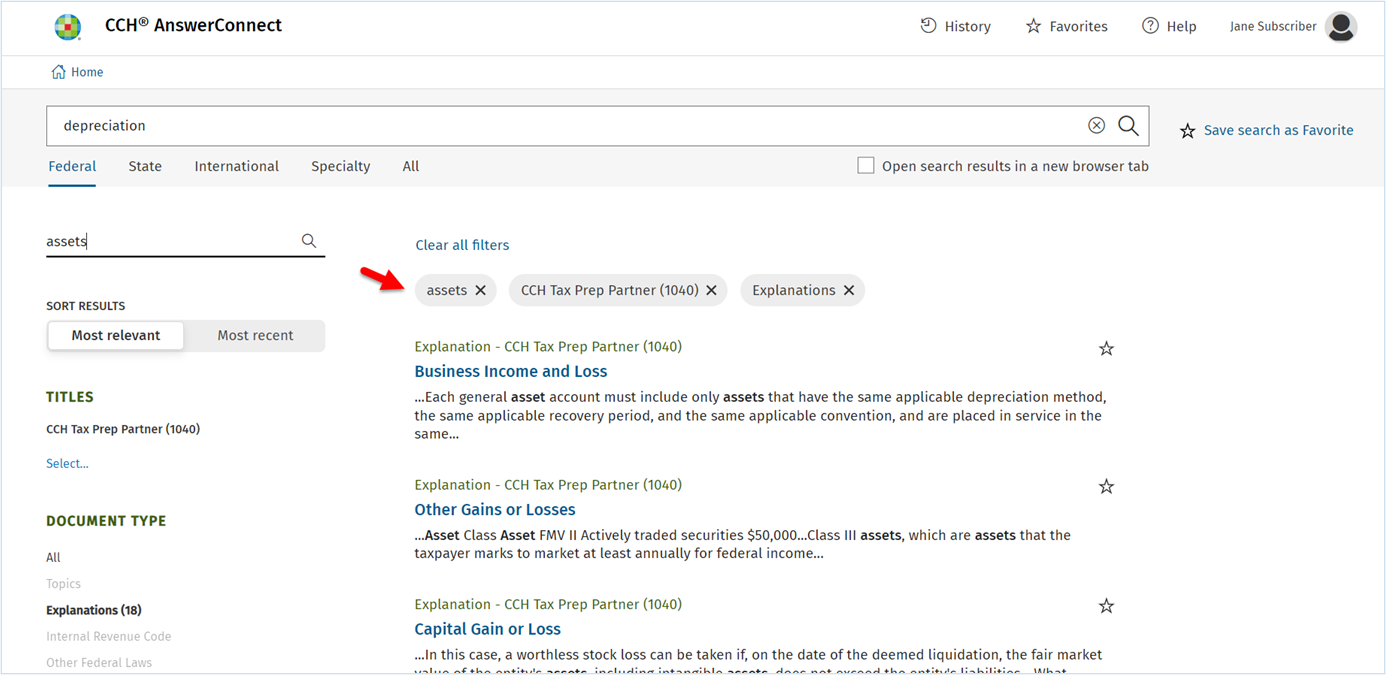

Enhanced Search Results

We’ve improved our search experience, making it easier for you to view and narrow your results:

- Toggle to sort results by Most relevant, or Most recent

- Slide-out panel to filter by Title & Jurisdiction

- Simpler, cleaner document display so you can scan the titles

Click to sort results by Most relevant, or Most recent

Under “TITLES,” use the slide-out panel to target specific content

Applied filters appear above the search results

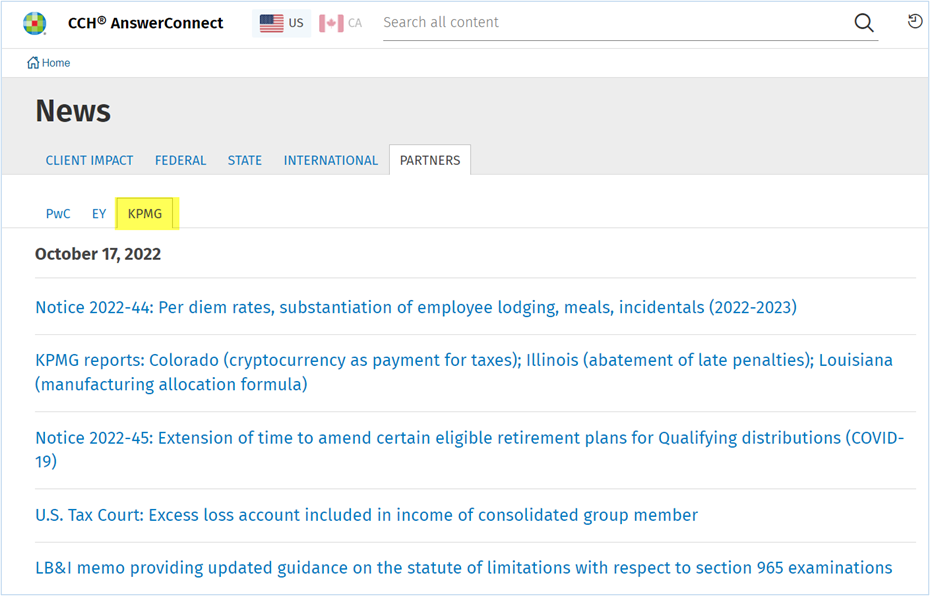

KPMG’s Analysis of Tax Developments

Add KPMG TaxNewsFlash - United States, to your daily CCH AnswerConnect email alerts. This valuable news source, authored by the Big Four firm’s Washington National Tax professionals, provides timely summaries, observations, and analysis of the latest tax developments in the United States.

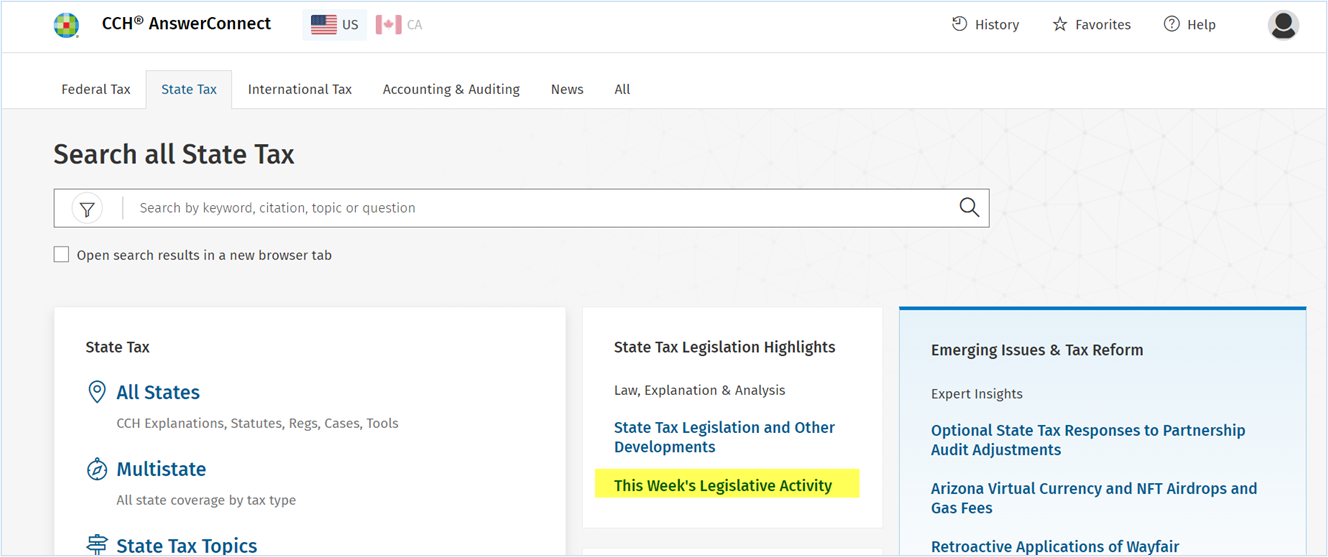

Review This Week’s State Tax Legislative Activity

Movement on state tax legislation (organized by state and bill number) during the past week, including:

- current status

- summaries and full-text of pending & enacted legislation

- legislative history & analysis

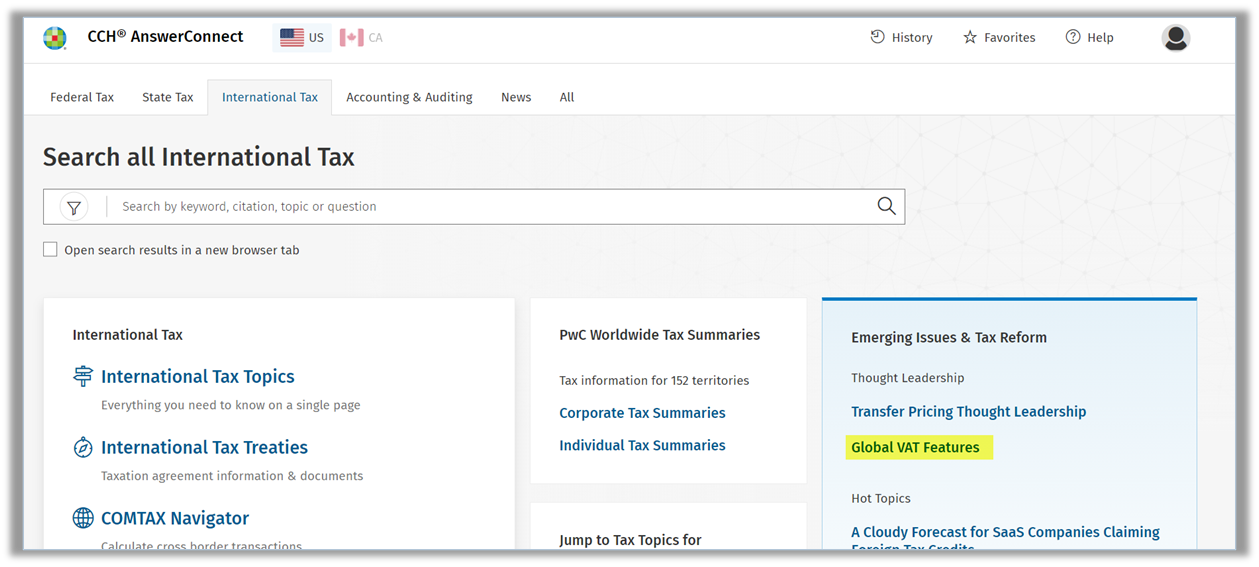

Global VAT Features (Thought Leadership)

In-depth features covering the latest trends, changes and reforms on VAT law from around the world.

Multistate Taxation: Model Statutes, Multistate Agreements, and Federal Laws

Quick access to a broad collection of resources promoting uniformity in tax systems, including multistate agreements, and model laws and regulations – such as:

- Uniform Division of Income for Tax Purposes Act (UDITPA)

- Multistate Tax Compact

- Streamlined Sales & Use Tax Agreement

- and much more…