Optimize State Tax Research

Create targeted alerts to better track state tax developments.

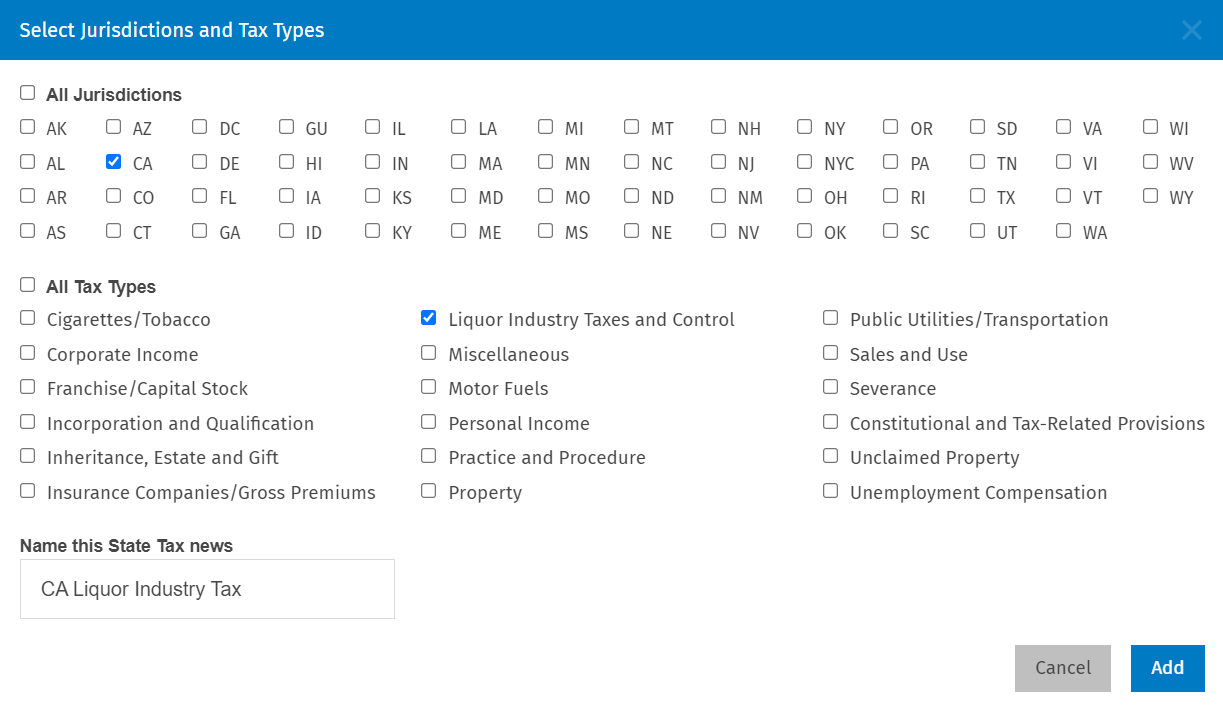

We have enhanced CCH AnswerConnect to offer more flexibility for state tax news alerts. Easily target states and tax types that matter most to you.

For example, you can now select to create a state tax news alert for Connecticut Corporate Income taxes or select multiple states with a select number of tax types.

Examples:

- CT + Corporate Income

- NJ + Property

- NY + Sales and Use

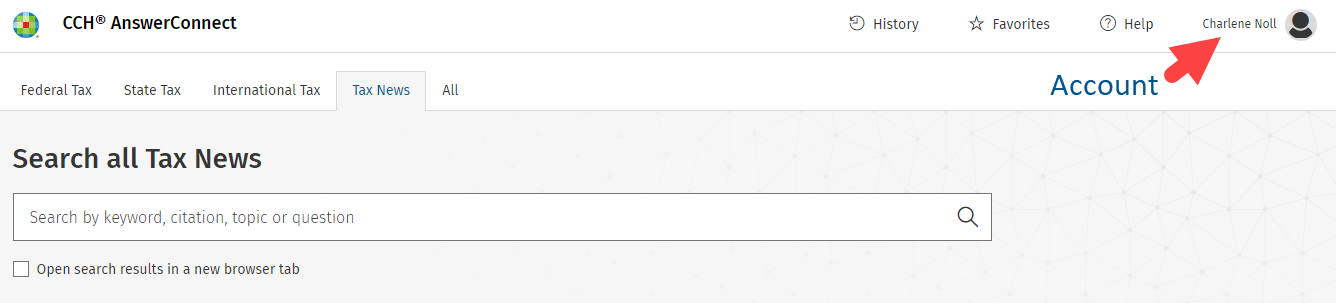

Follow these simple steps in your Account menu to setup separate, targeted state tax alerts.

Account Settings

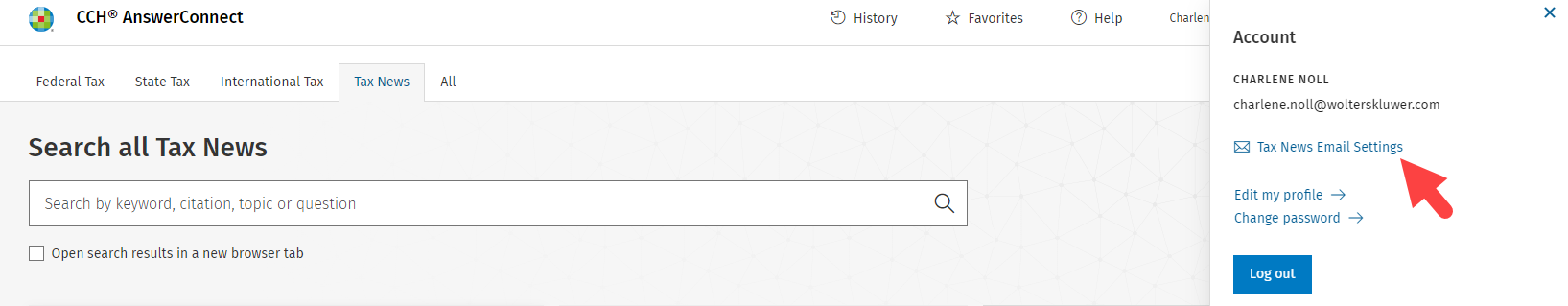

Tax News Email Settings

Configure Multiple Alerts

Choose State(s) & Tax Type(s)

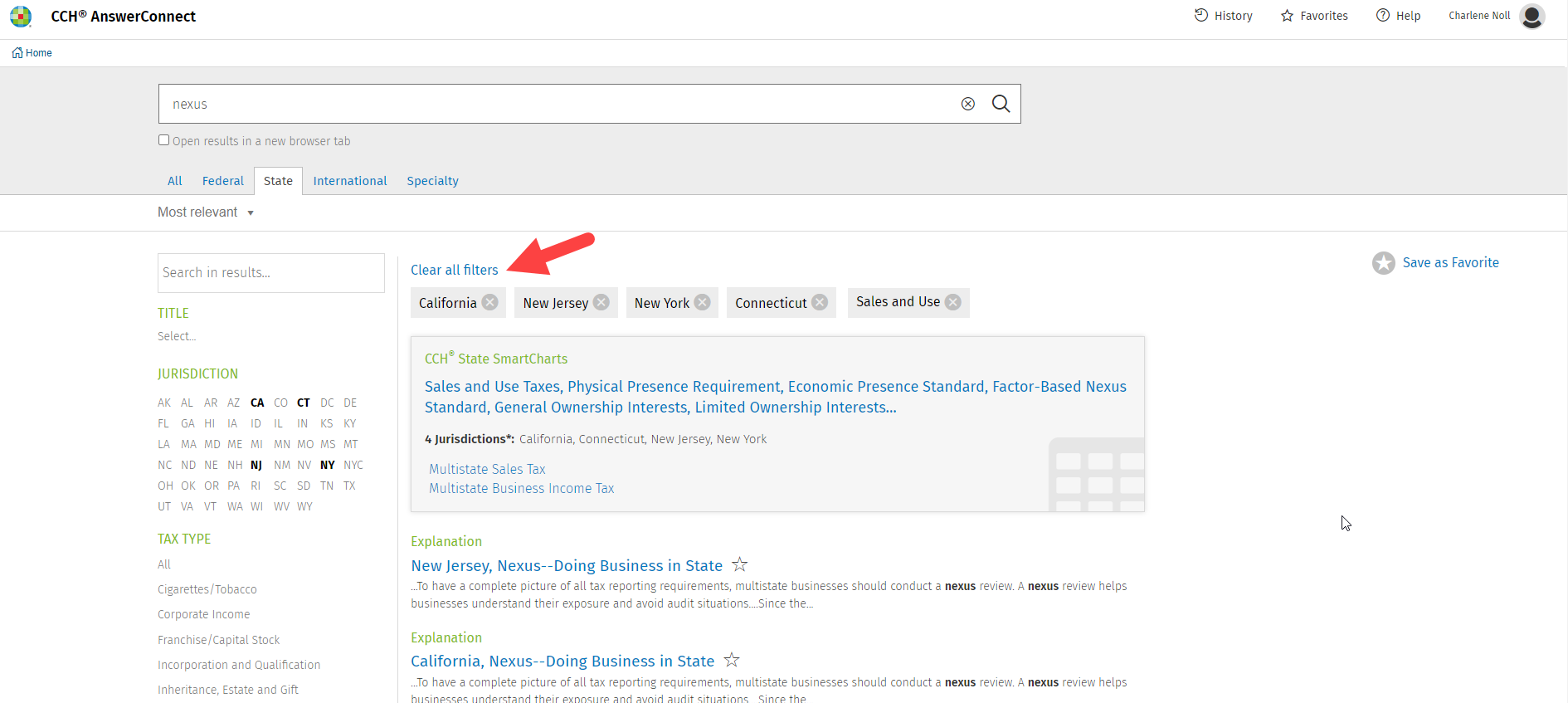

Run multiple state tax searches with fewer clicks.

When you select jurisdictions and tax types, those search settings are saved until you clear the filters. Gain efficiencies when you face challenging state tax scenarios.

Save/Clear State Tax Search Criteria

Easily Track Law Changes

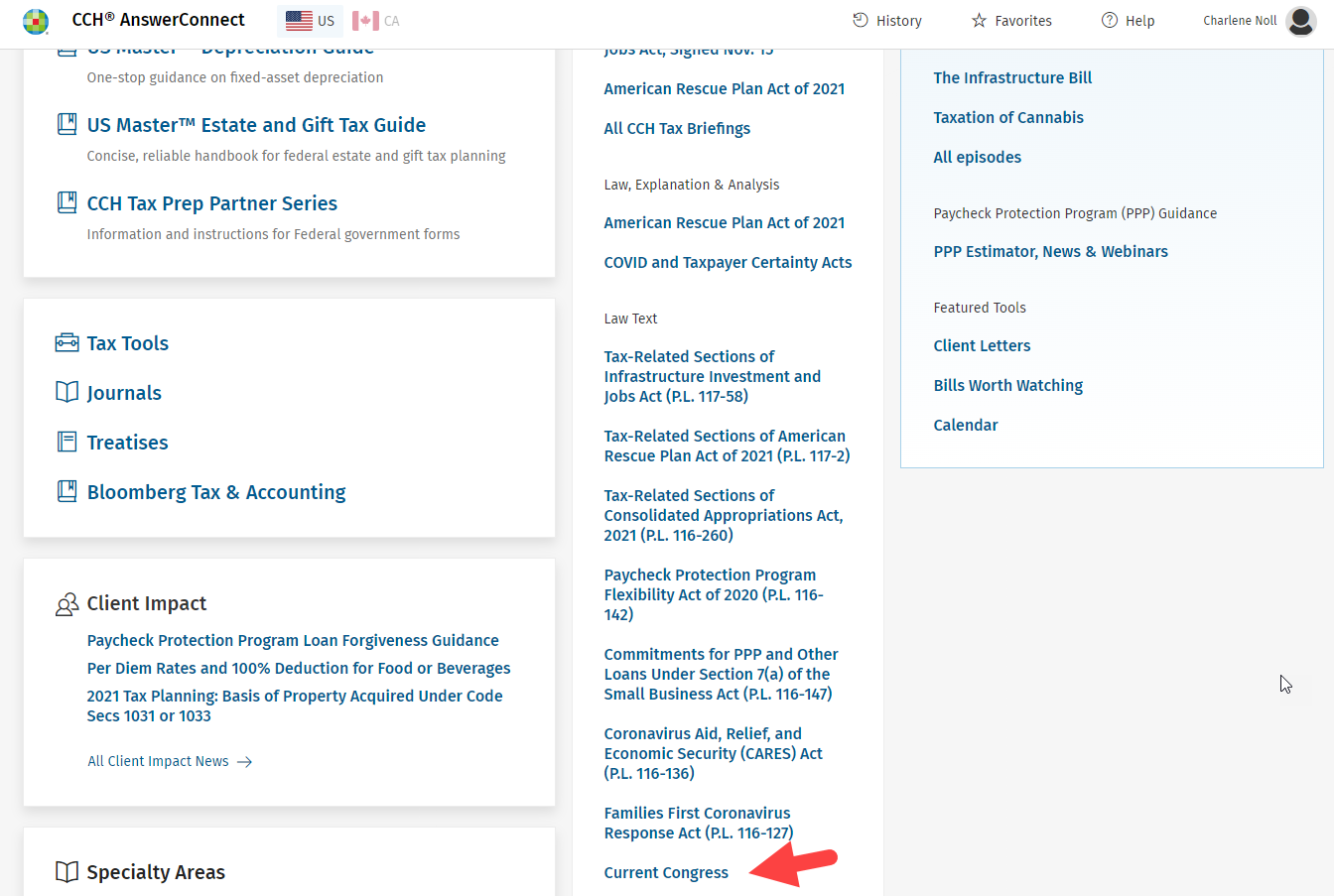

Find the latest federal tax bills and committee reports in one location.

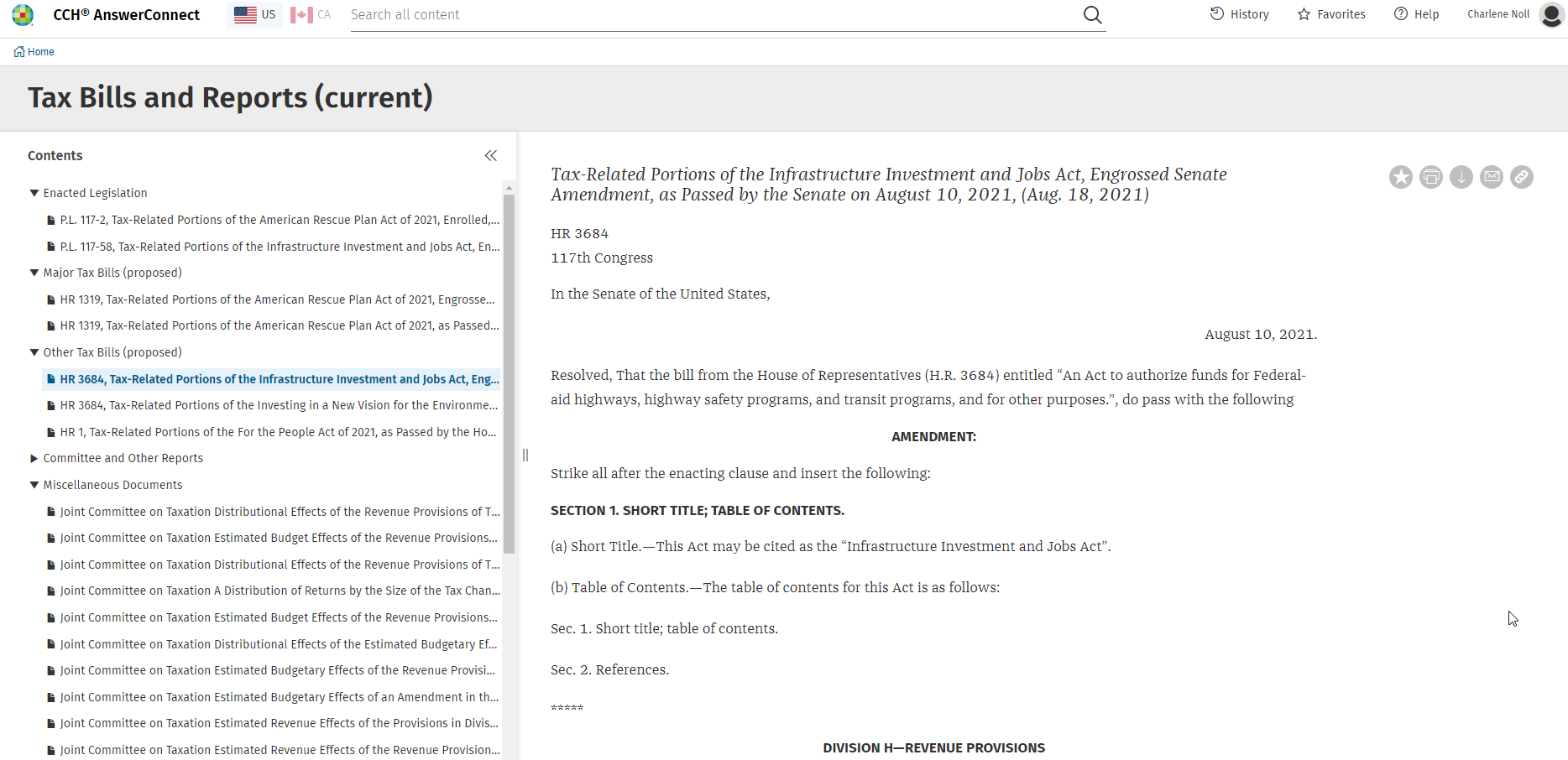

For the current session of Congress, find the text of all tax bills introduced and committee reports issued. Click Current Congress to reach:

- Enacted Legislation

- Major Tax Bills

- Other Tax Bills

- Committee and other Reports

- Miscellaneous Documents

Current Congress – Federal Tab

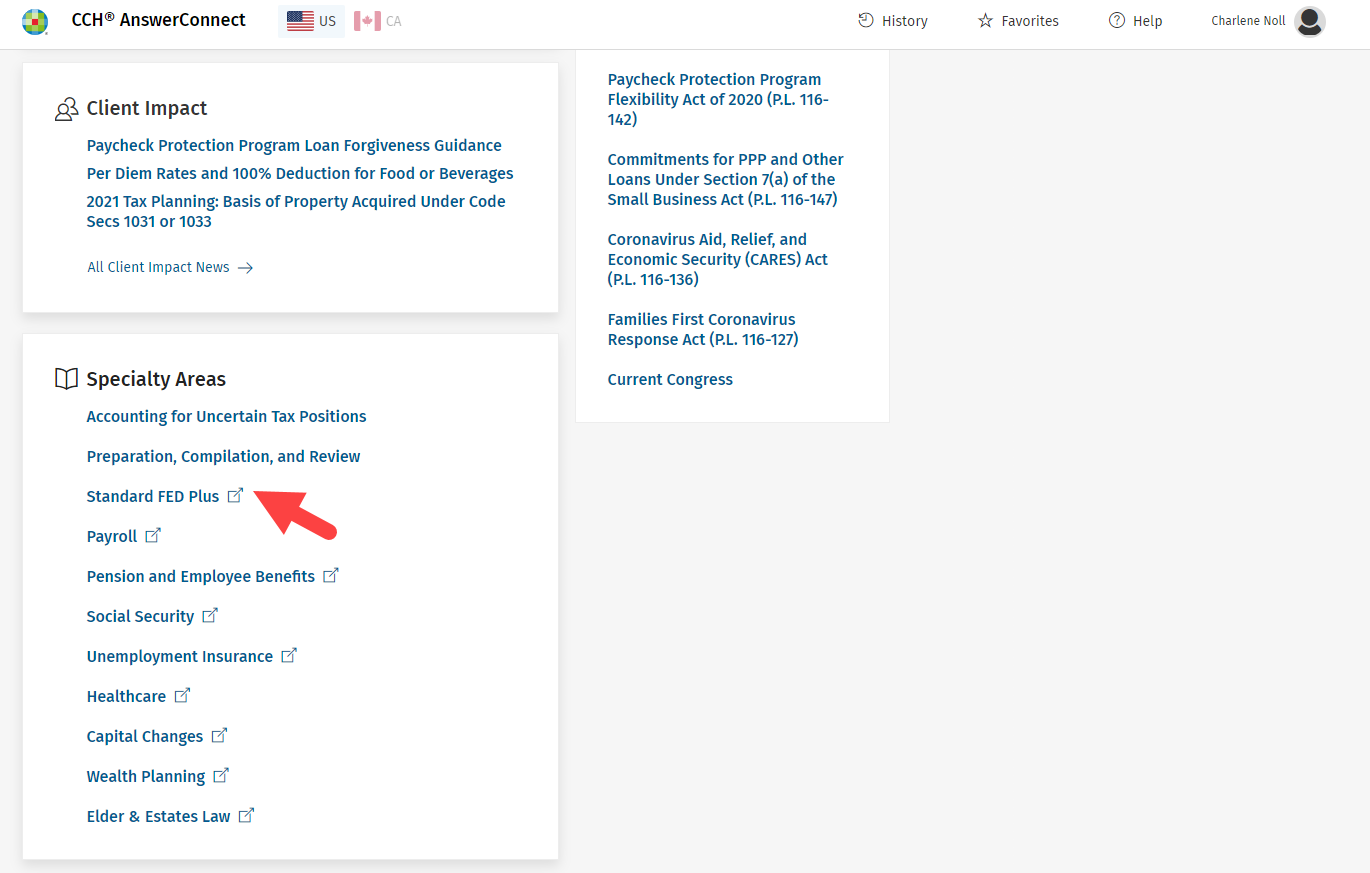

Compare current & previous versions of laws or regulations using Standard FED Plus.

CCH AnswerConnect provides a centralized location to efficiently monitor and understand federal tax statutory and regulatory changes. Accelerate tax research and better advise your clients with access to:

- Legislative alerts

- Legislative change dashboard

- Point-in-time analysis

- Redlining of changes

- Calendar features

Standard FED Plus – Federal Tab

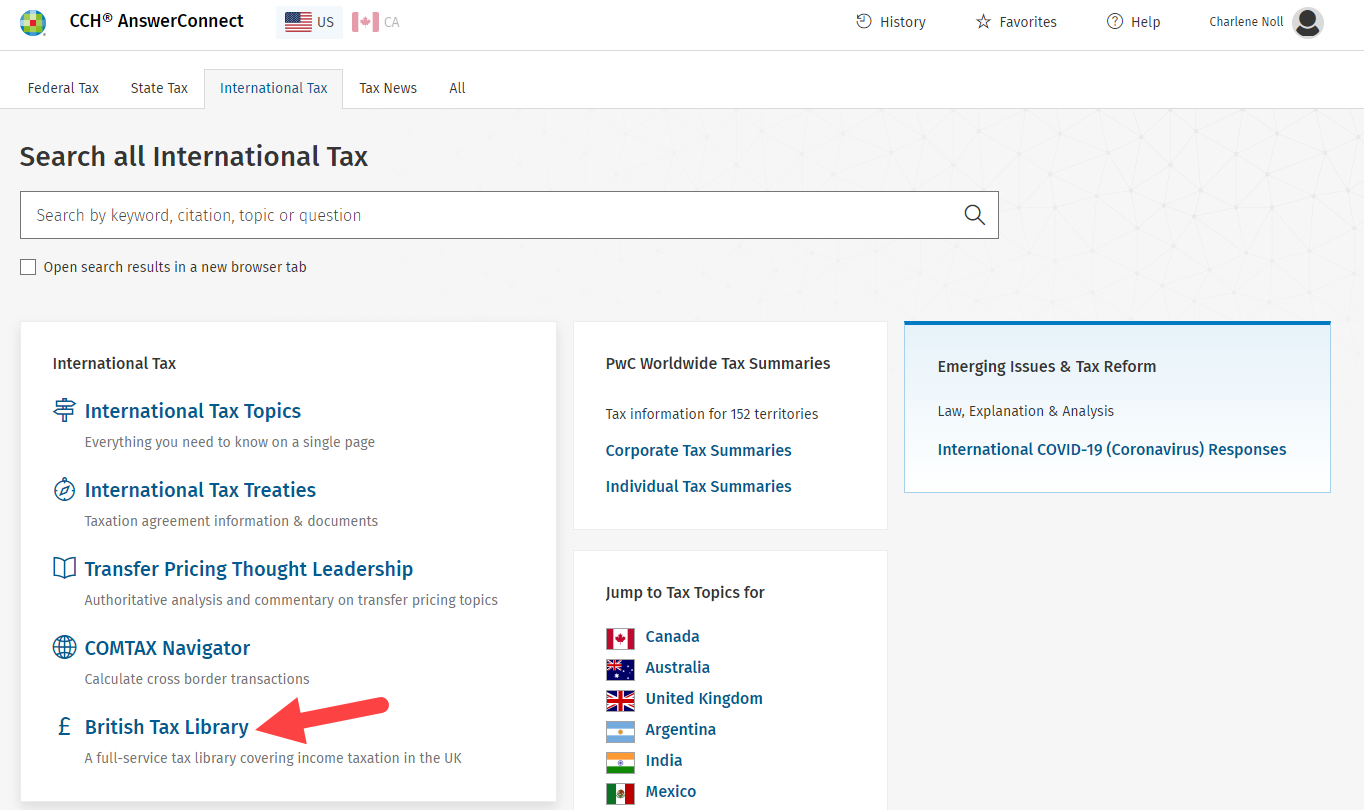

Gain Extensive Coverage of UK Direct Taxes

Find practical information and guidance on a wide range of topics.

For each area of tax, a What's New page identifies and links to the most recently updated commentary. From the commentary, link to relevant legislation and cases. The British Tax Library covers:

- Latest tax developments & legislative updates

- Extensive range of tax topics, such as:

- o Income, Corporation & Capital Gains Taxes

- o Tax Credits

- o National Insurance Contributions

- o Petroleum Revenue Tax

- o Value Added Tax

- HMRC Revenue Manuals

- Cases (plus extensive case archive)

British Tax Library – International Tab

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.