(Please be aware: you may not see all of these updates, depending on your subscription. For more information, reach out to your sales contact.)

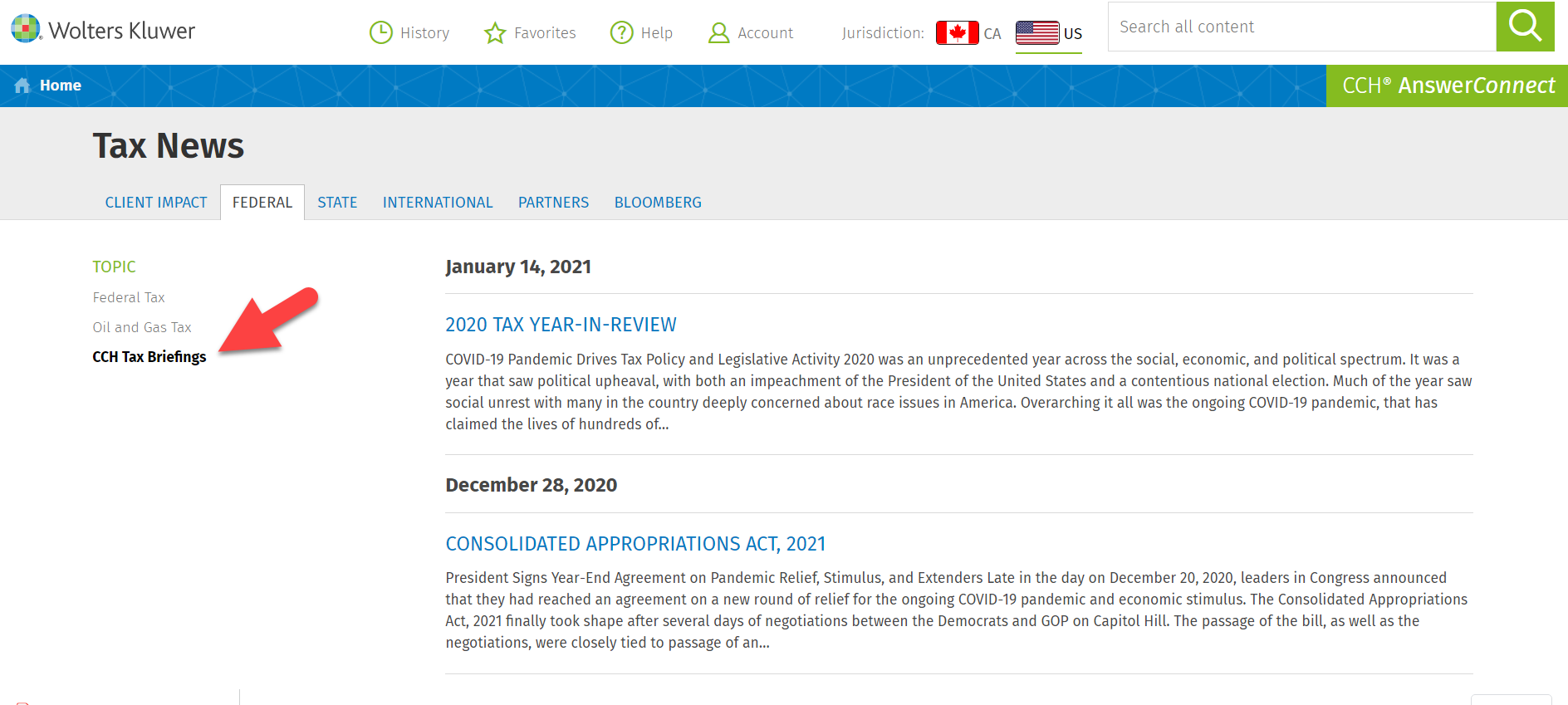

Browse & Search CCH Tax Briefings

We know how much you rely on CCH’s Tax Briefings for up to date expert analysis of impactful new law and regulatory changes. Now on CCH AnswerConnect, in addition to having access to the latest briefing on hot topics, you also have access to past Tax Briefings, and can easily search for them.

CCH Tax Briefings

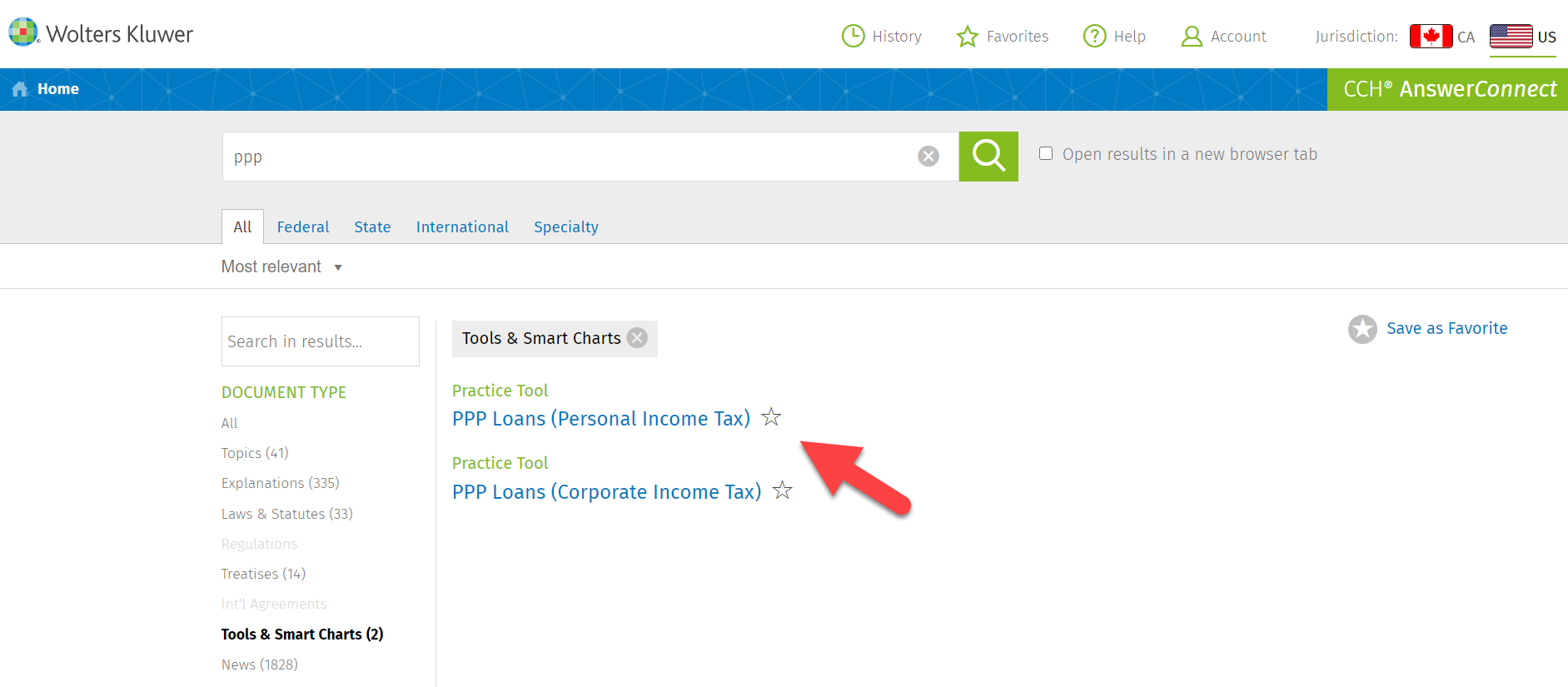

PPP Loan Tools

The PPP Loans (Personal Income Tax) and PPP Loans (Corporate Income Tax) are comparisons of state conformity to federal treatment of cancelled debt, including the new federal provisions on forgiven PPP loans and expenses paid for with the forgiven load amounts.

To easily find these new tools, search for PPP and filter for Tools & Smart Charts.

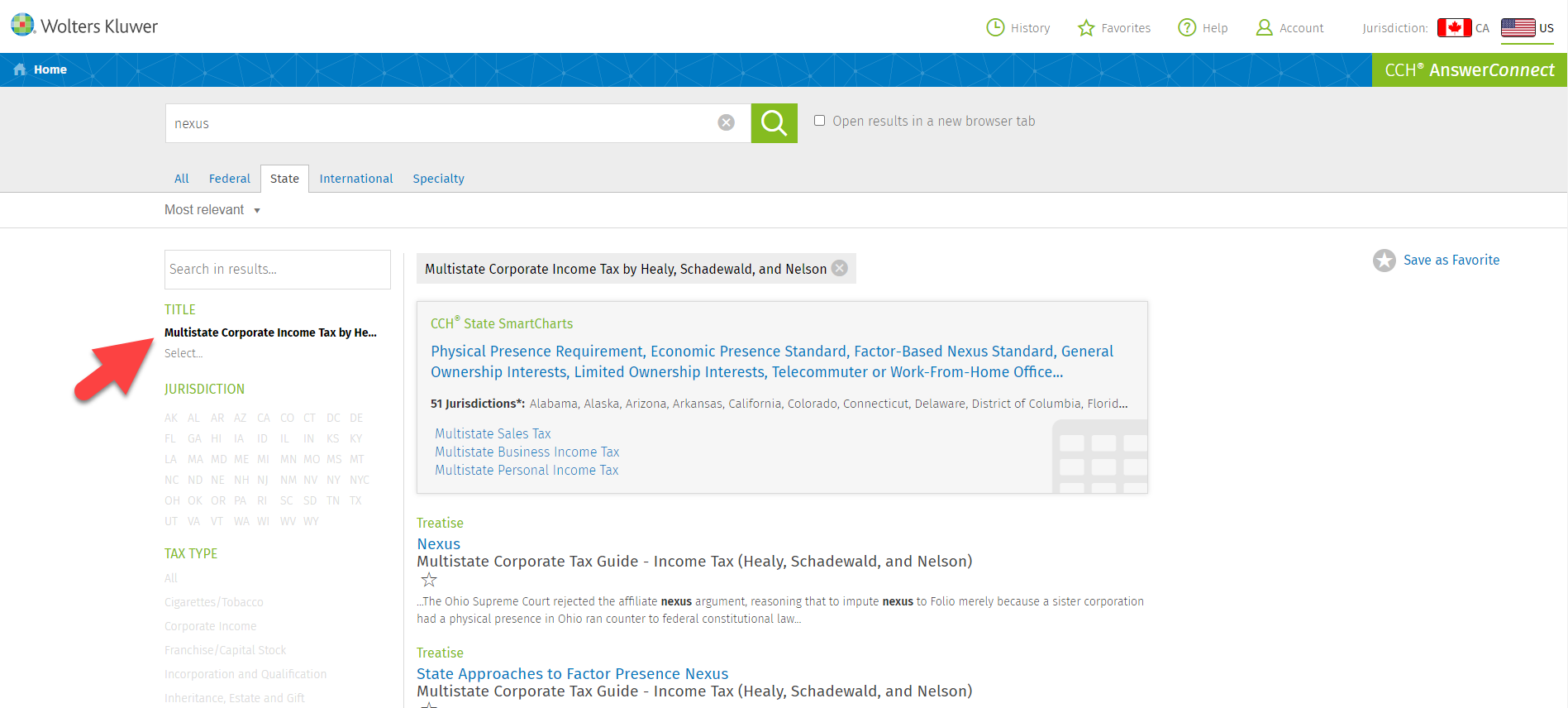

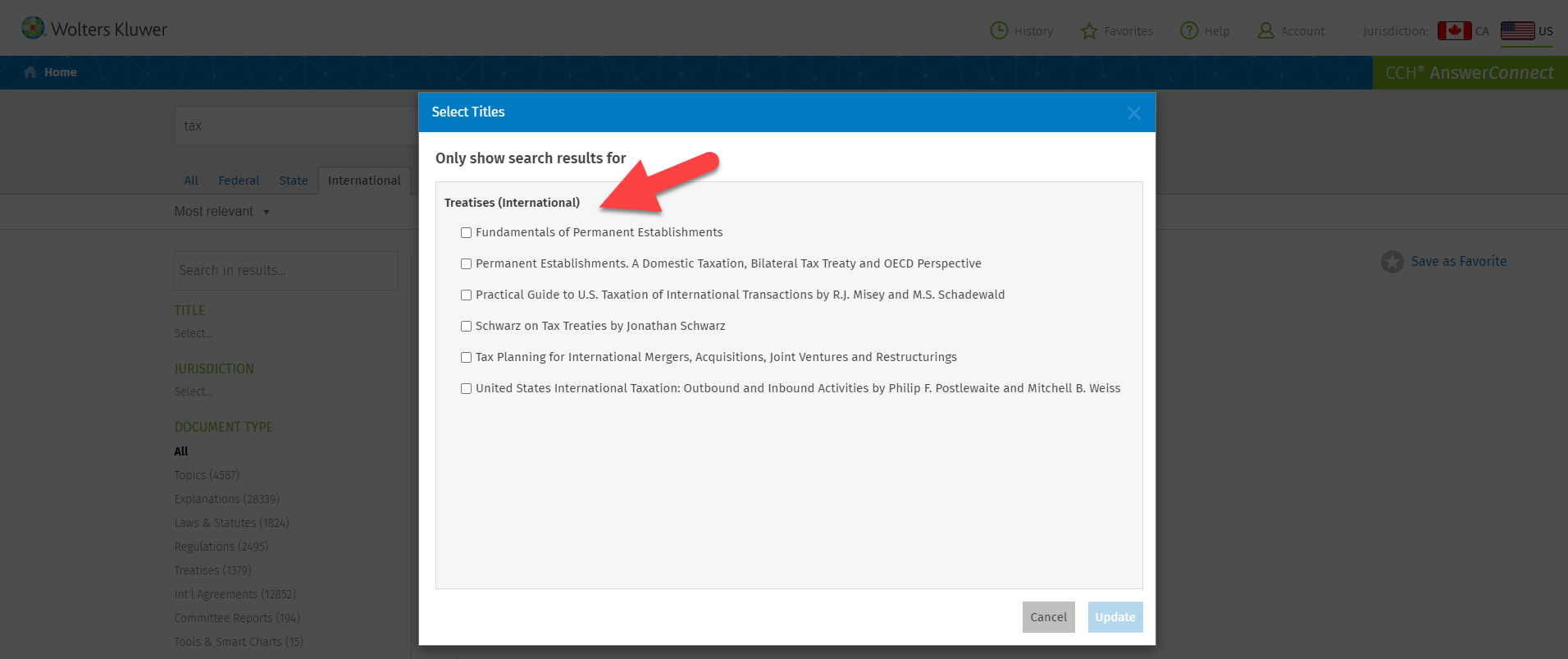

Scoped Search Feature – State & International Treatises

CCH AnswerConnect now allows you to Search within a title to target your research. We have added all the State & International Tax Treatises as part of this feature so that you can search within a particular content set.

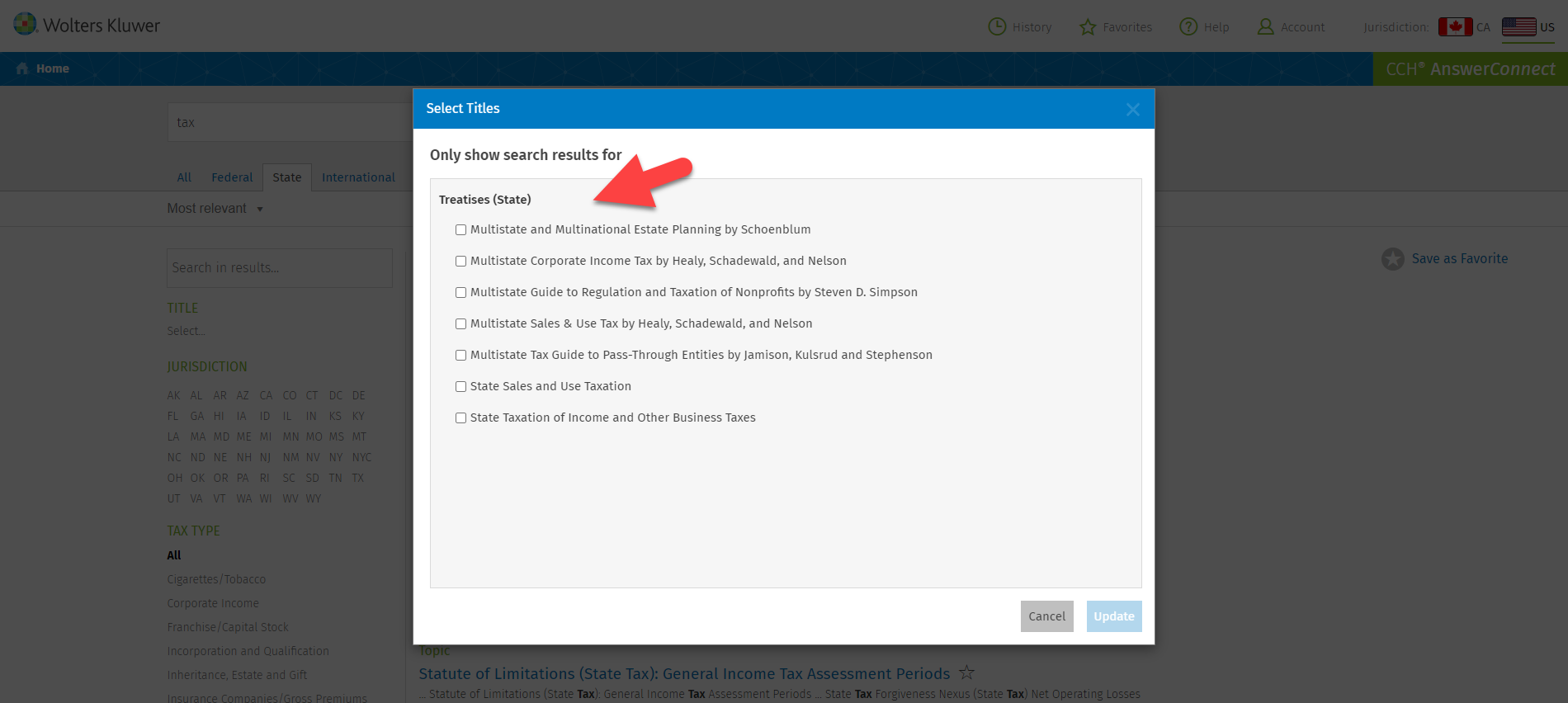

To run a focused search, navigate to any State or International Treatise or select the titles once you have run a search from the State or International Search Results tab. Here are some screen shots that show how this can be done in two different ways.

- Browse to a State or International Treatise - Table of Contents and run your search

- Scope your search to any State or International Treatise

When searching under the State or International tab, select the title you want to focus your search on.

You can select from a list of State Treatises (depending on your subscription):

You can select from a list of International Treatises (depending on your subscription):

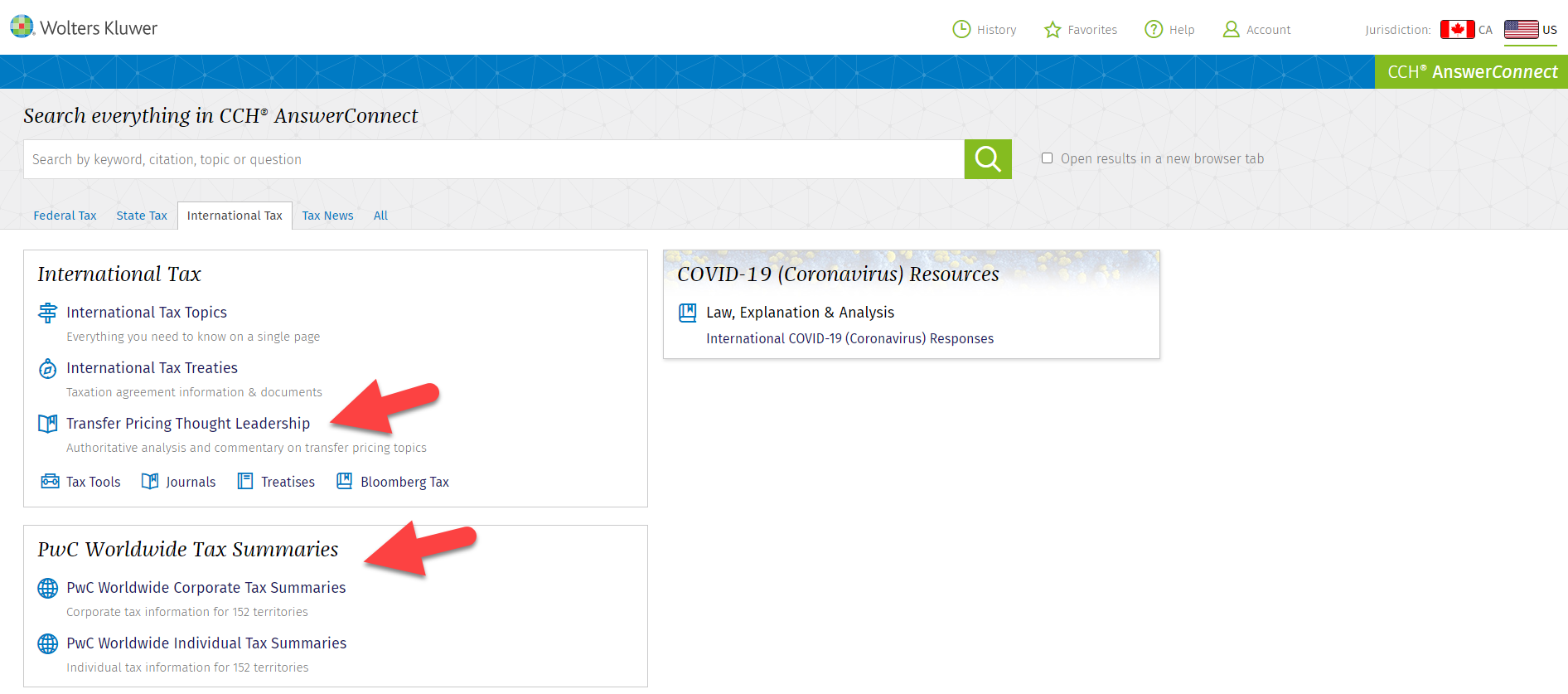

Additions to International Home Page

Transfer Pricing Thought Leadership was added to the International tab, allowing you to easily access this collection of articles written by the big 4 accounting firms and global law firms. These articles provide additional in-depth commentary on hot topics and developing trends in global transfer pricing. The PwC Worldwide Tax Summaries have also been added to the International tab. Now you will be able to browse directly to the Corporate or Individual tax summaries for 152 countries right from the home page. Once this content is selected, you will be able to navigate directly to a specific jurisdiction and topic, streamlining your research.

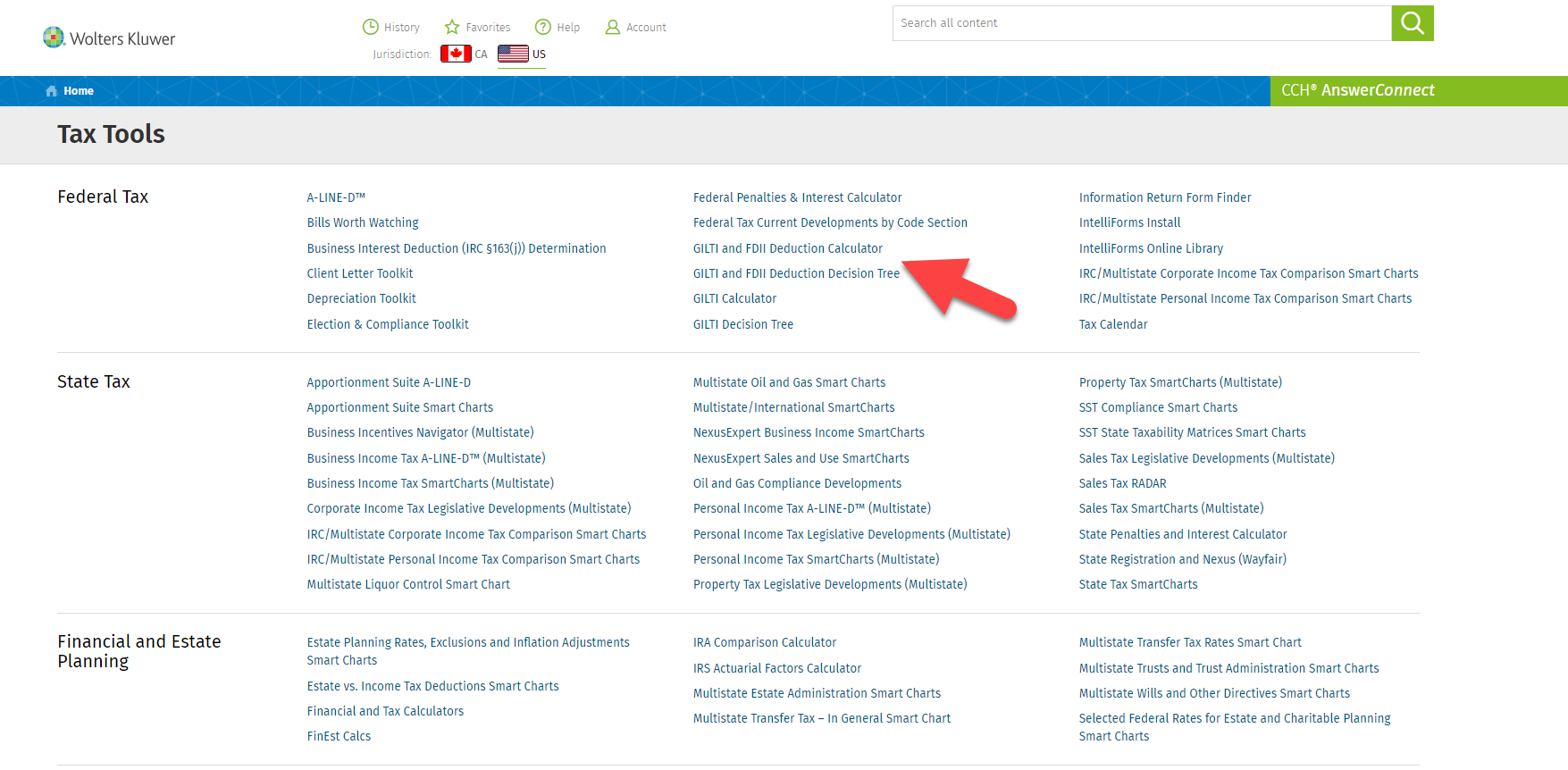

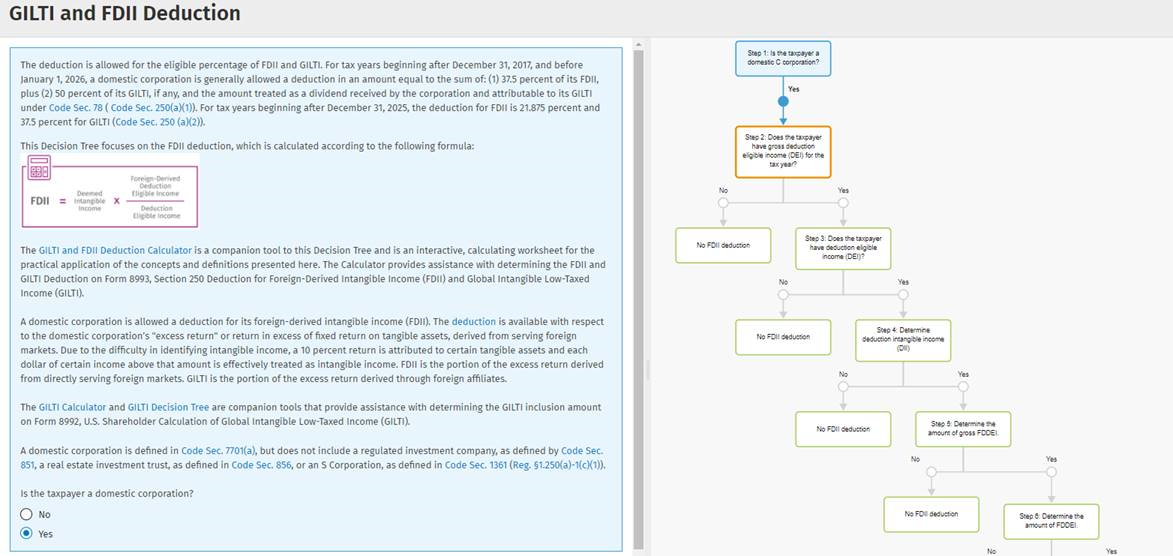

New GILTI Tools - GILTI and FDII Deduction Decision Tree and Calculator

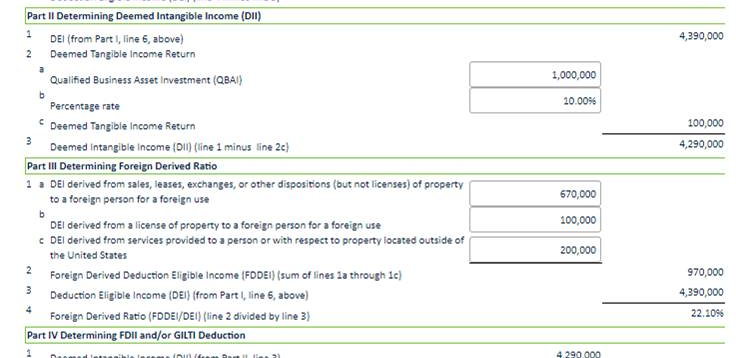

The GILTI and FDII Deduction Calculator is an interactive worksheet that aids with determining the FDII and GILTI Deduction on Form 8993, Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). This tool works together with the GILTI Calculator and GILTI Decision Tree, which help with determining the GILTI inclusion amount on Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI).

The GILTI and FDII Deduction Decision Tree provides the steps, definitions, and rules needed to determine the GILTI and FDII deduction and complete the GILTI and FDII Calculator as well as Form 8993, Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI).

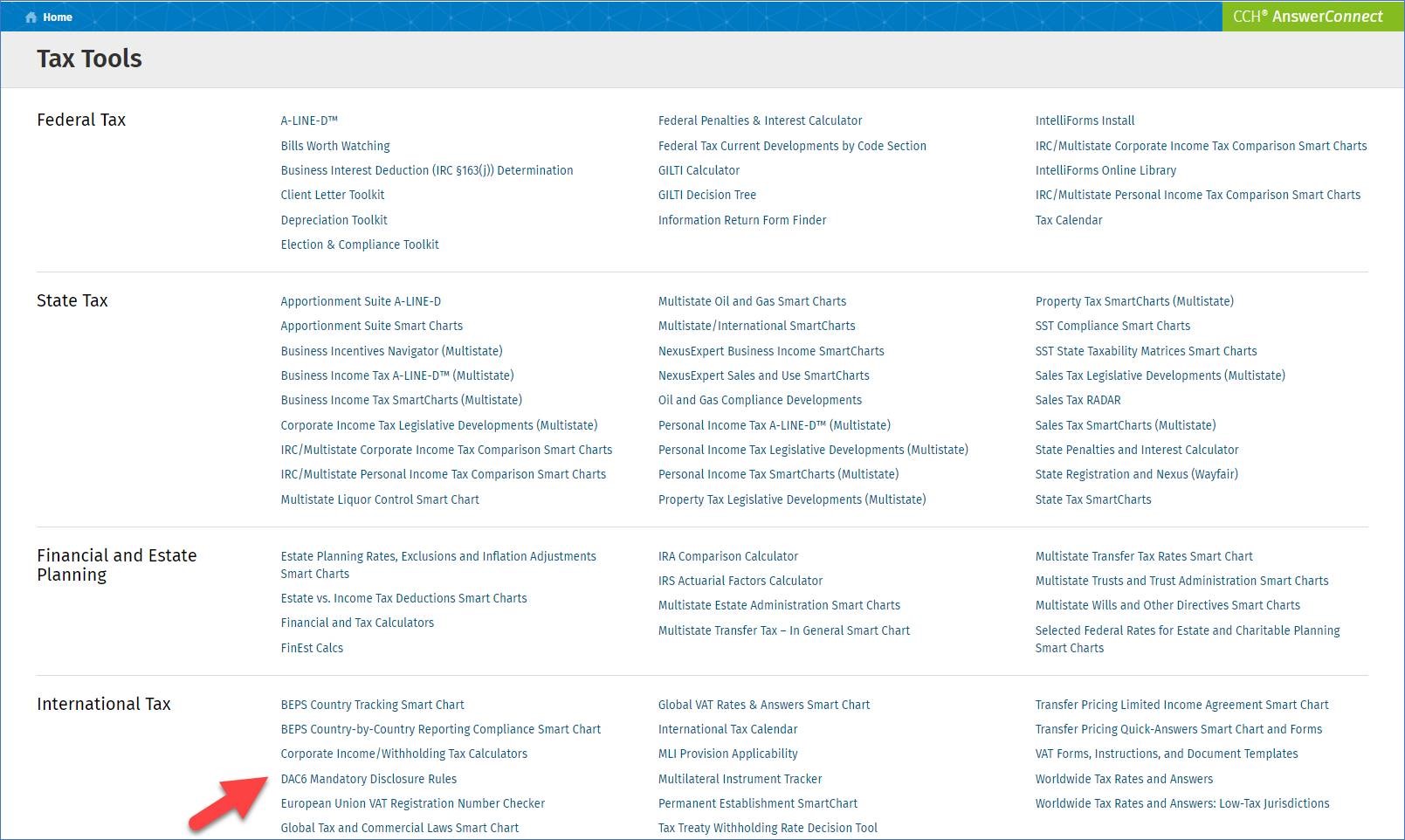

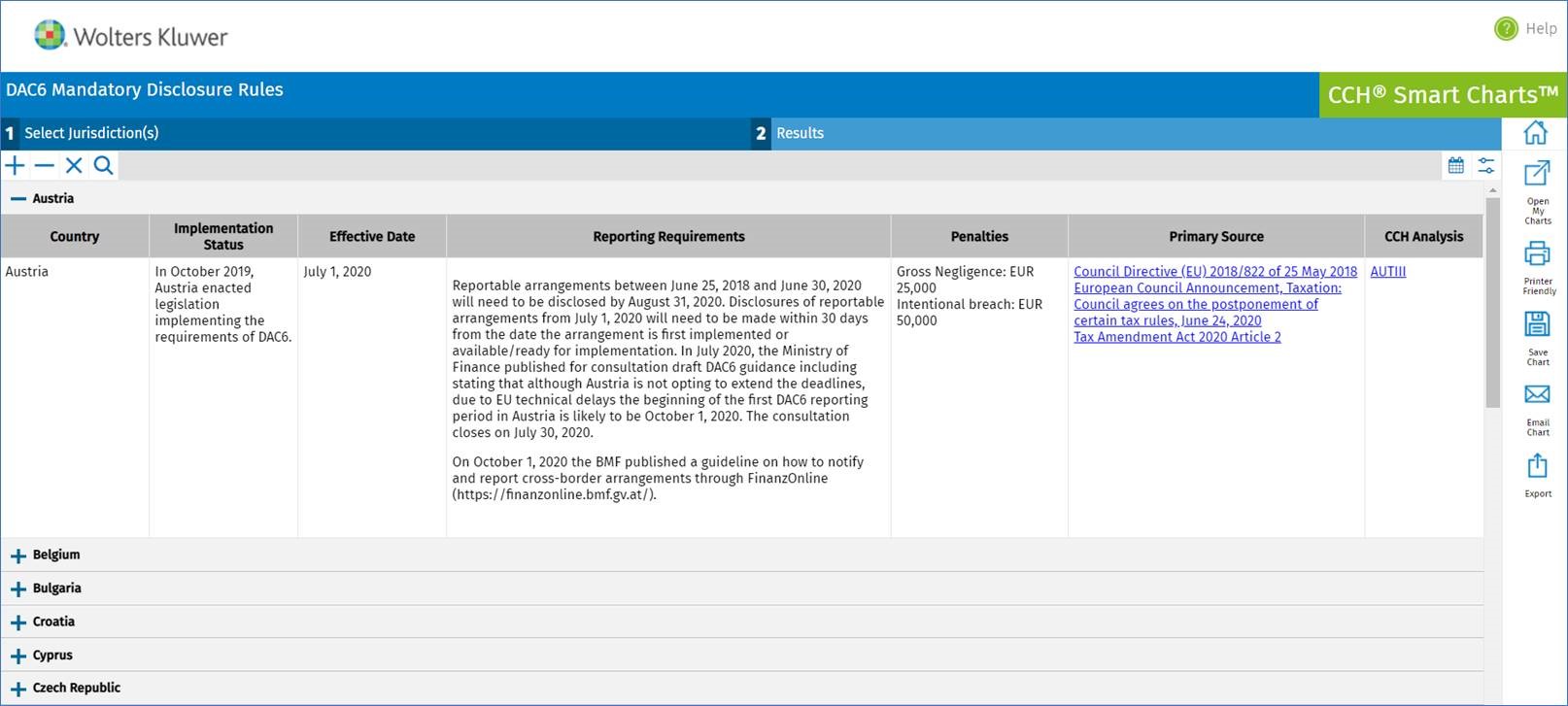

DAC6 Mandatory Disclosure Rules

On the Tools listing page, you can now easily access the DAC6 Mandatory Disclosure Rules Smart Chart (depending on your subscription). This tool provides information regarding the implementation of DAC6/MDR in the EU (*the United Kingdom is also included in this chart).

Capital Changes

Under the Specialty Areas, you can also now easily access Capital Changes U.S. content on Cheetah (depending on your subscription).

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.