(Please be aware: you may not see all of these updates, depending on your subscription. For more information, reach out to your sales contact.)

Update to COVID-19 (Coronavirus) Resources

We are continuing to update our COVID-19 resources to help keep you informed. Critical new resource content has been added to provide guidance on the Paycheck Protection Program (PPP). PPP Estimator, powered by Paychex, reflects the most current developments including the simplified forgiveness process for loans of $50,000 or less.

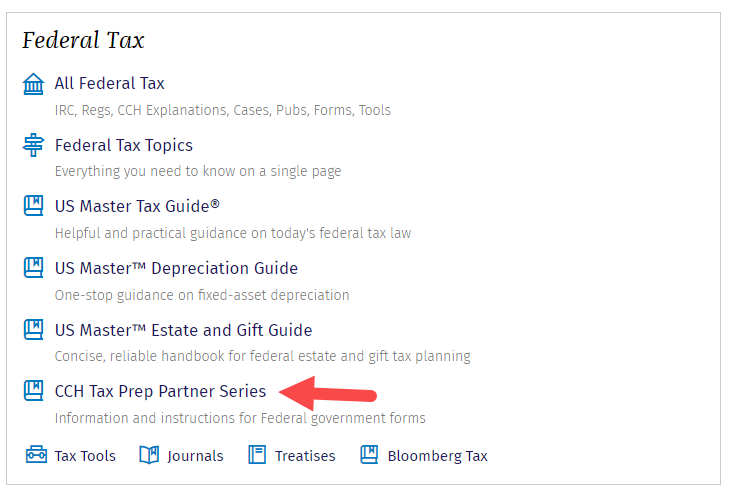

Enhanced Navigation – Tax Prep Partner Series

By enhancing Tax Prep Partner (TPP), now you can easily navigate to critical content from the Home Page or Search results in CCH AnswerConnect. Junior staff can easily get to step-by-step guidance when preparing federal tax returns, with practical guidance, filled-in forms, compliance tips and an extensive set of workflow tools to direct them. Seasoned professionals can quickly find guidance on complex areas of a form, or a quick answer when something new or unexpected arises on a return.

Access practice aids for a tax issue all from one place – interactive examples, worksheets, decision tools and more. TPP is available for Forms 1040, 1041, 1065, 1120, 1120S, 706/709, 990, 5500, Information Returns, Tax Practice & Procedure, International, and Payroll.

Scoped Search Feature

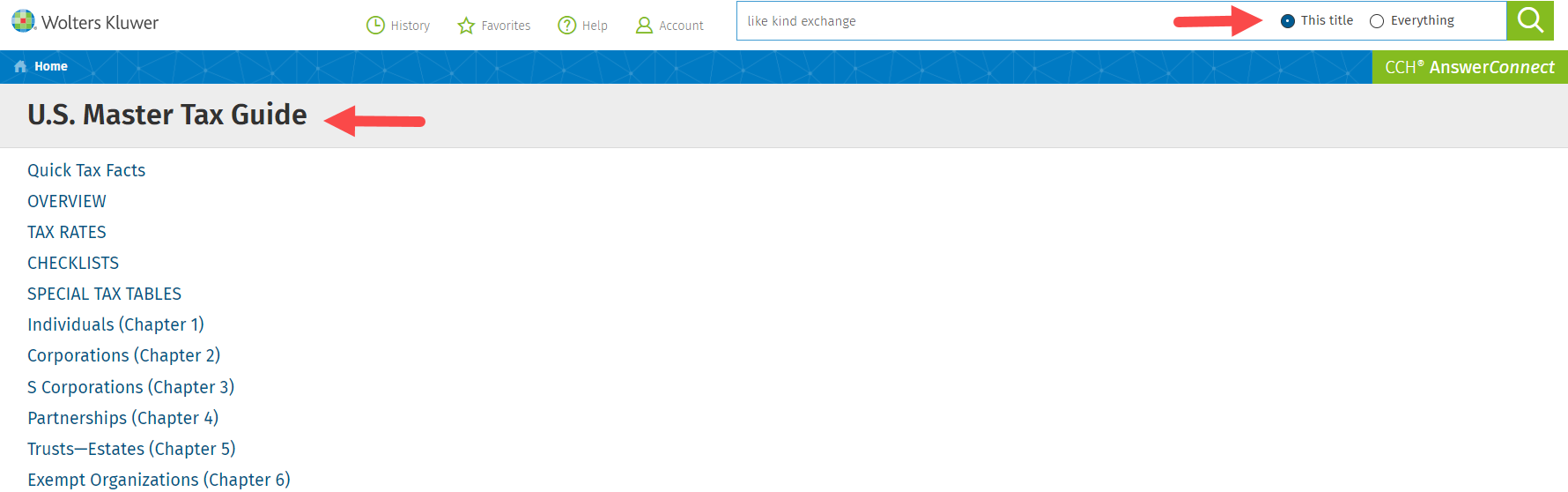

CCH AnswerConnect now allows you to Search within a title to target your research.

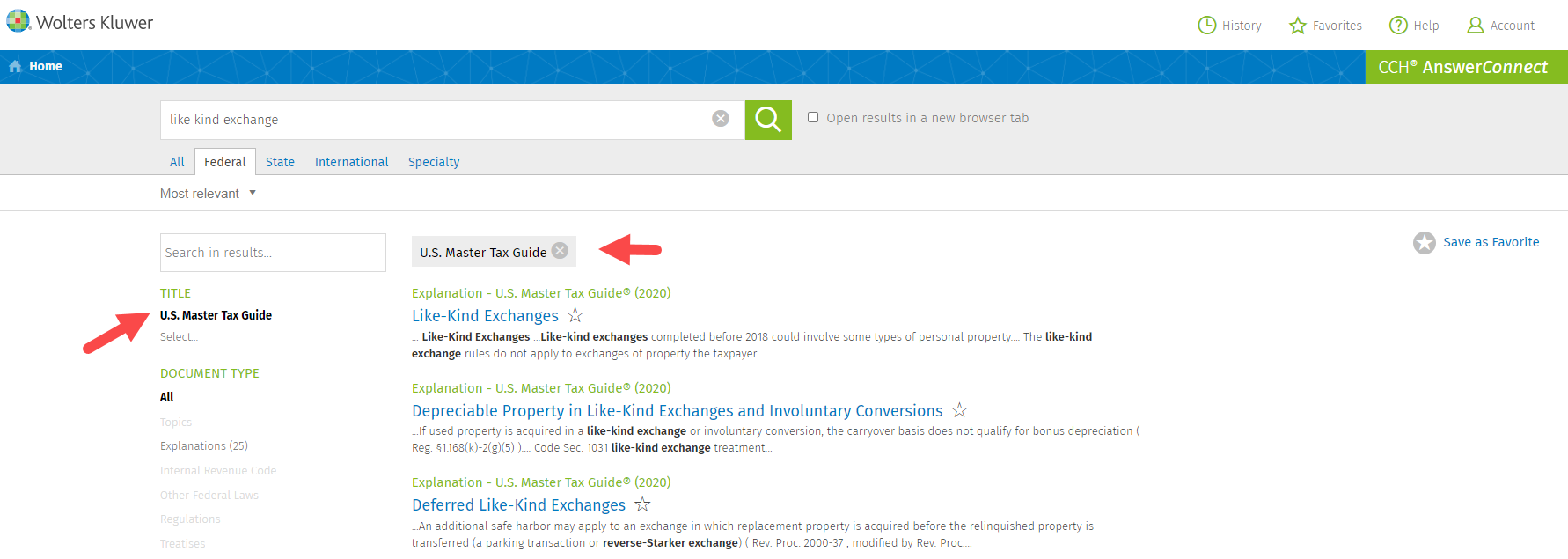

To run a focused search, navigate to the content through the Table of Contents or select the titles once you have run a search from the Federal Search Results tab. Here are some screen shots that show how this can be done in two different ways:

- Browse to the Table of Contents and run your search

- Scope your Federal search results

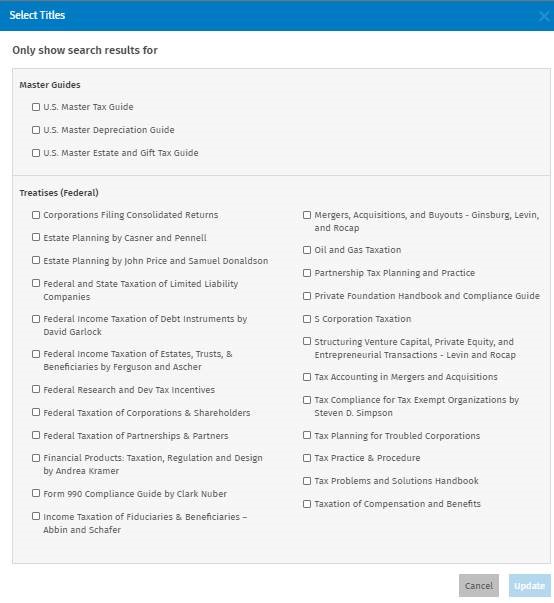

When searching under the Federal tab, you can select the title you want to focus your search results.

You can select from this list of products (depending on your subscription):

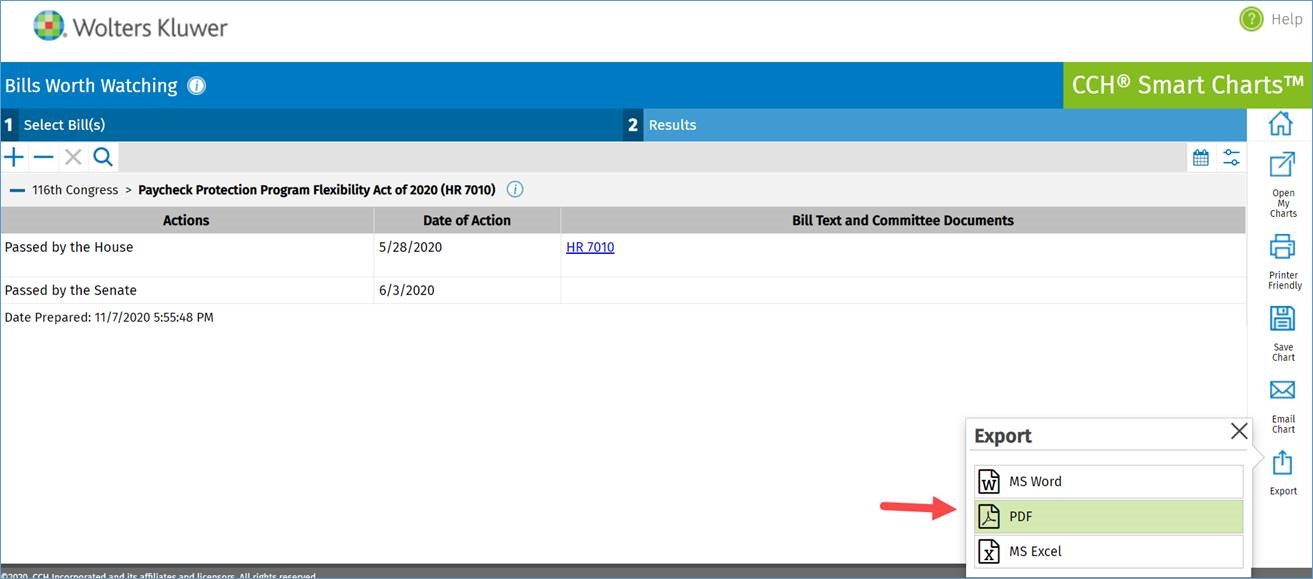

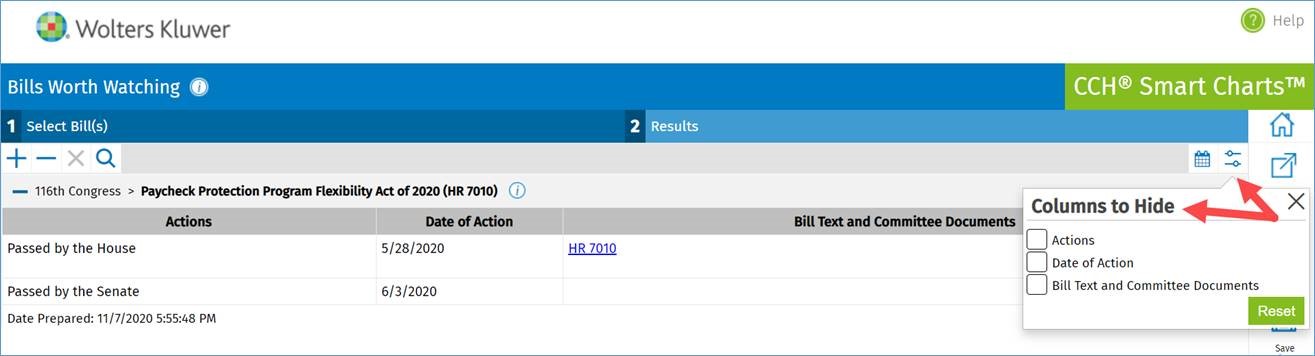

Smart Charts Improvements

For some CCH Smart Charts, we have added a new PDF export and email attachment option. additionally, we added the option to hide/show columns on the Smart Chart results screen. If a column can be hidden, an “X” will display in the column header when you hover over a column heading. When columns are hidden, it will be reflected in the exported files and email attachments.

Browser Search Plugin

We added support for Microsoft Edge version 86.0 and newer. Edge users can use this link to install the browser extension.

Updates to Tax News and Alerts

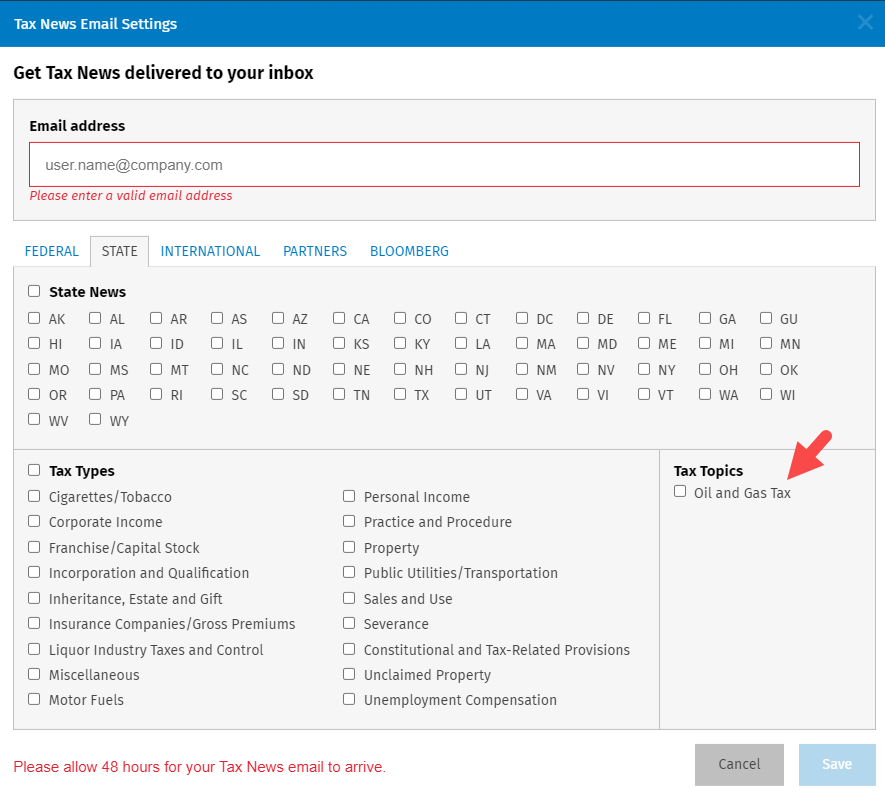

Oil & Gas Tax News and Alerts

Oil & Gas news now covered in CCH AnswerConnect. Setup an email alert to have this content delivered to your inbox.

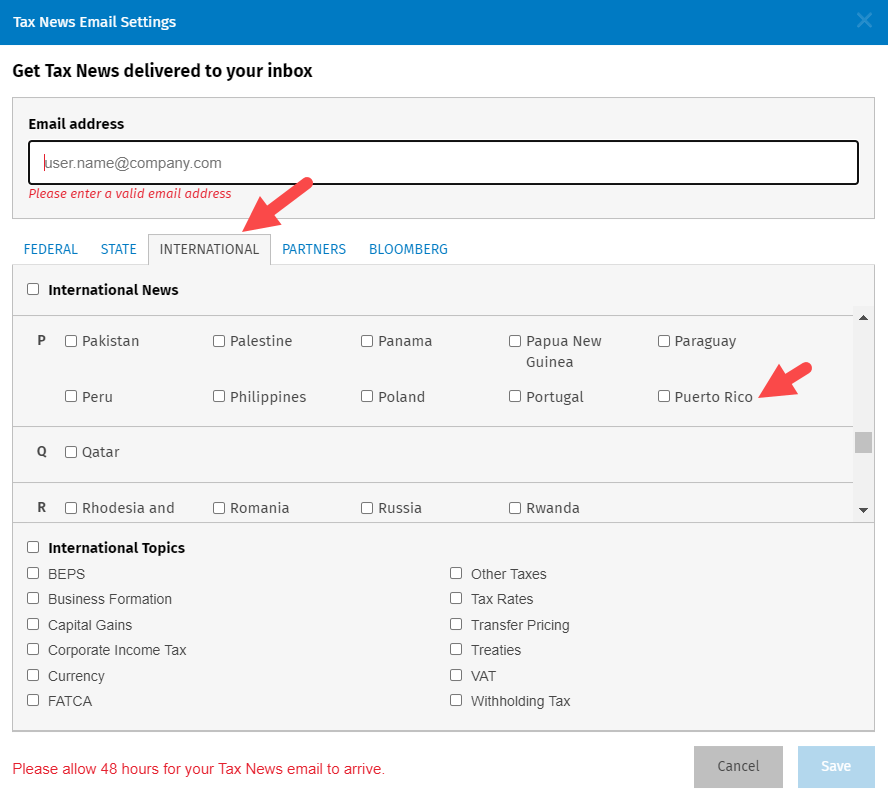

Email Alerts for Puerto Rico News

Sign up for Puerto Tax News and get it delivered straight to your inbox.

New Content Sets

CCH AnswerConnect provides you with the most comprehensive, in-depth coverage of Federal, State & International tax content. With this release, you may have access (depending on your subscription) to:

New Federal Topics

- Constitutionality and Tax Protestors

- Tax Treaties

Estate Planning Content

US Master Estate and Gift Tax Guide

This guide provides up to date content on the latest changes regarding estate and gift tax planning and preparation. This guide serves as a reliable resource with concise information that will benefit CPAs, tax advisors, and estate representatives.

Trust and Estate Treatises & Journal

Added two Treatises, and a journal: Federal Income Taxation of Estates, Trusts, & Beneficiaries by Ferguson and Ascher, Income Taxation of Fiduciaries & Beneficiaries – Abbin and Schafer, and the Estate Planning Review Journal.

IRS Publications

Expanded IRS Publications coverage to include: IRS Publications 448, 904, and 950.

Oil & Gas

The Oil & Gas Tax Reporter

A comprehensive resource that provides authoritative, up-to-date content and tax strategies to guide professionals through the complexities of oil and gas taxation issues.

Multistate Oil and Gas Smart Charts

Oil and Gas Compliance Developments.

New Tools

Federal Tax Current Developments by Code Section

New International Topics

Latin America (Argentina, Brazil, Chile, Columbia, Costa Rica, Ecuador, Mexico, Peru, Uruguay, and Venezuela)

- Asset Tax (Latin America)

- Taxes on Assets (Latin America)

- Business Formation (Latin America)

- Forms of Doing Business (Latin America)

- Business Regulations (Latin America)

- Labor Regulations (Latin America)

- Legal System (Latin America)

- Taxation System (Latin America)

- Corporate Income Tax (Latin America)

- Introduction to Taxation (Latin America)

- Administration of the Tax Law (Latin America)

- Taxation of Resident Entities (Latin America)

- Taxation of Nonresident Entities (Latin America)

- Tax Credits (Latin America)

- Reporting and Payment of Tax (Latin America)

- Business Income and Allowances (Latin America)

- Tax Treaties (Latin America)

- Tax Accounting (Latin America)

- Individual Income Tax (Latin America)

- Taxation of Resident Individuals (Latin America)

- Taxation of Nonresident Individuals (Latin America)

- Income and Allowances (Latin America)

- Individual Reporting and Payment of Tax (Latin America)

- Other Taxes (Latin America)

- Excise Tax (Latin America)

- Other Taxes (Latin America)

- Customs and Duties (Latin America)

- Social Welfare Contributions (Latin America)

- Status Changes and Liquidations (Latin America)

- Entity Formation, Reorganization and Liquidation (Latin America)

- Tax Incentives (Latin America)

- Promotional Regimes (Latin America)

- Transfer Pricing (Latin America)

- Transfer Taxes (Latin America)

- Value Added Tax (Latin America)

Bloomberg Tax

Access Bloomberg Tax and CCH content through CCH AnswerConnect directly. We have made it easier for you to search and find this content through one integrated search platform with over twenty additional content sets!

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.