(Please be aware: you may not see all of these updates, depending on your subscription. For more information, reach out to your sales contact.)

COVID-19 Tools Updated – Q3 & Q4 Rule Changes

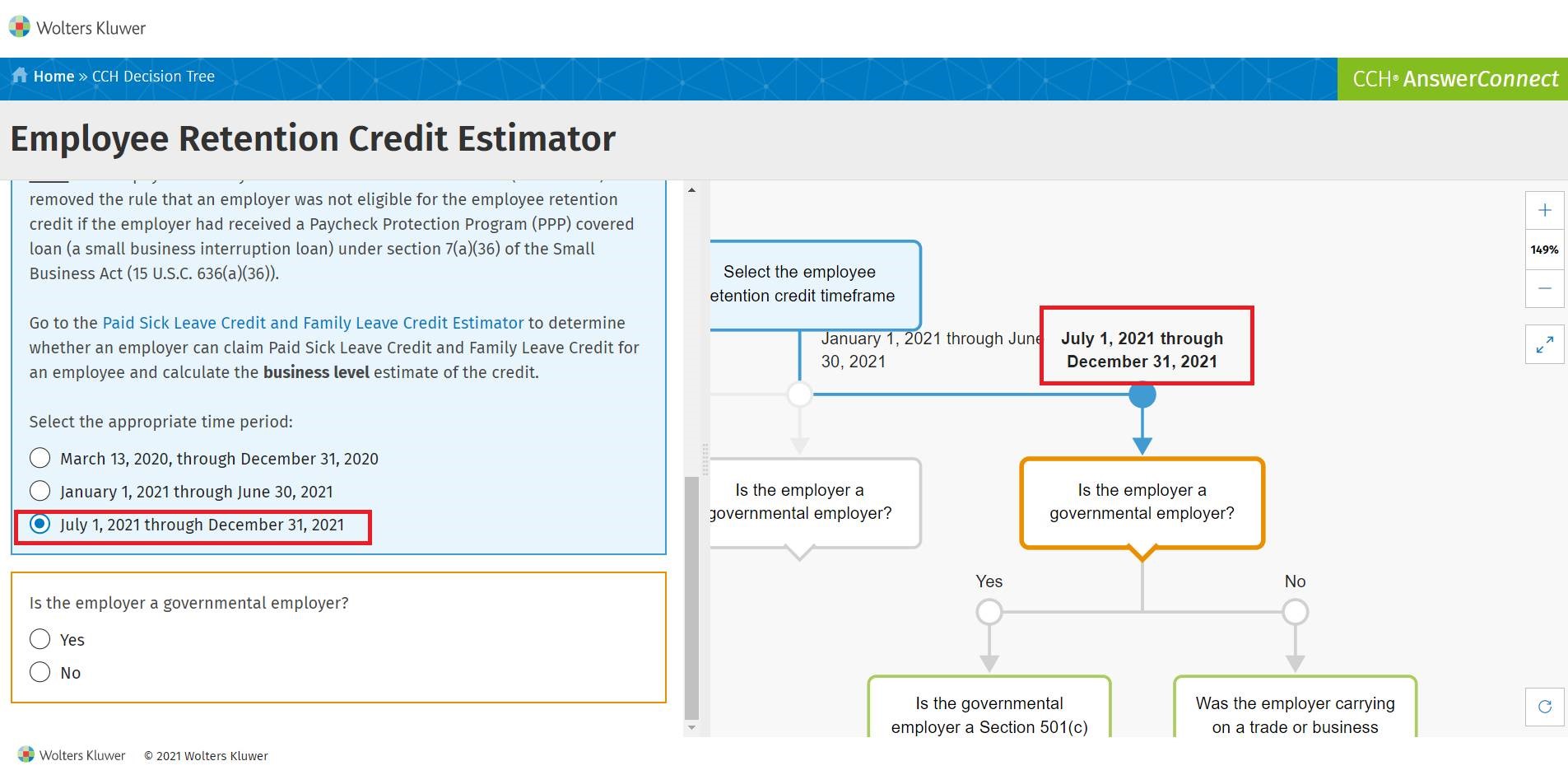

With the extension of employment tax credits, we are pleased to add functionality to our Featured Tools within our COVID-19 (Coronavirus) Resources. The Employee Retention Tax Credit (ERC) was extended through the end of 2021, and an option is available in our Estimator for the July 1 – December 31 timeframe, allowing you to estimate the benefit of the ERC for Q3 & Q4. The tool reflects the latest changes the IRS made to Form 941 Worksheets.

- Employee Retention Tax Credit Estimator (through December 31, 2021)

- Paid Sick Leave Credit & Family Leave Credit Estimator (through September 30, 2021)

CCH AnswerConnect COVID-19 Resources

State Tax Content Additions

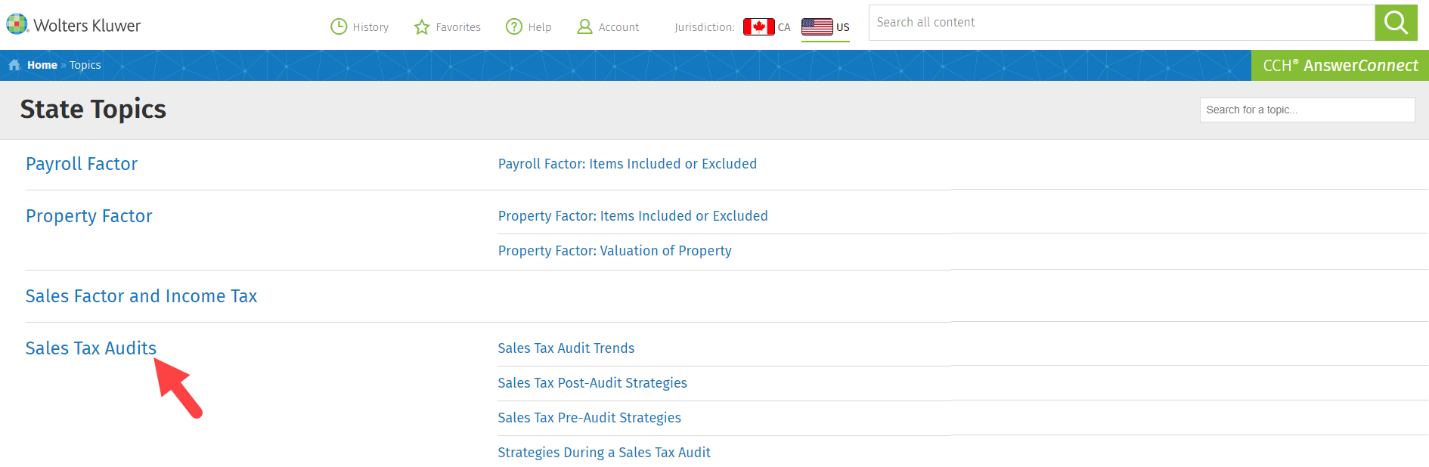

New Topic Pages – Surviving a Sales & Use Tax Audit

These topic pages provide insights into the strategies and issues related to each stage of an audit. You’ll find topics on:

Sales Tax Audits

- Sales Tax Audit Trends

- Sales Tax Post-Audit Strategies

- Sales Tax Pre-Audit Strategies

- Strategies During a Sales Tax Audit

International Content Additions

New Expatriates & Migrants Topic Pages

We’ve added topic pages covering expatriates and migrants to help you analyze the tax consequences and opportunities of international executive transfer or migration. You’ll find topics on:

Tax Residence for Individuals

- Scope of Taxation and Determining Residence

- Practical Treatment of Expatriate Employees and Immigrants

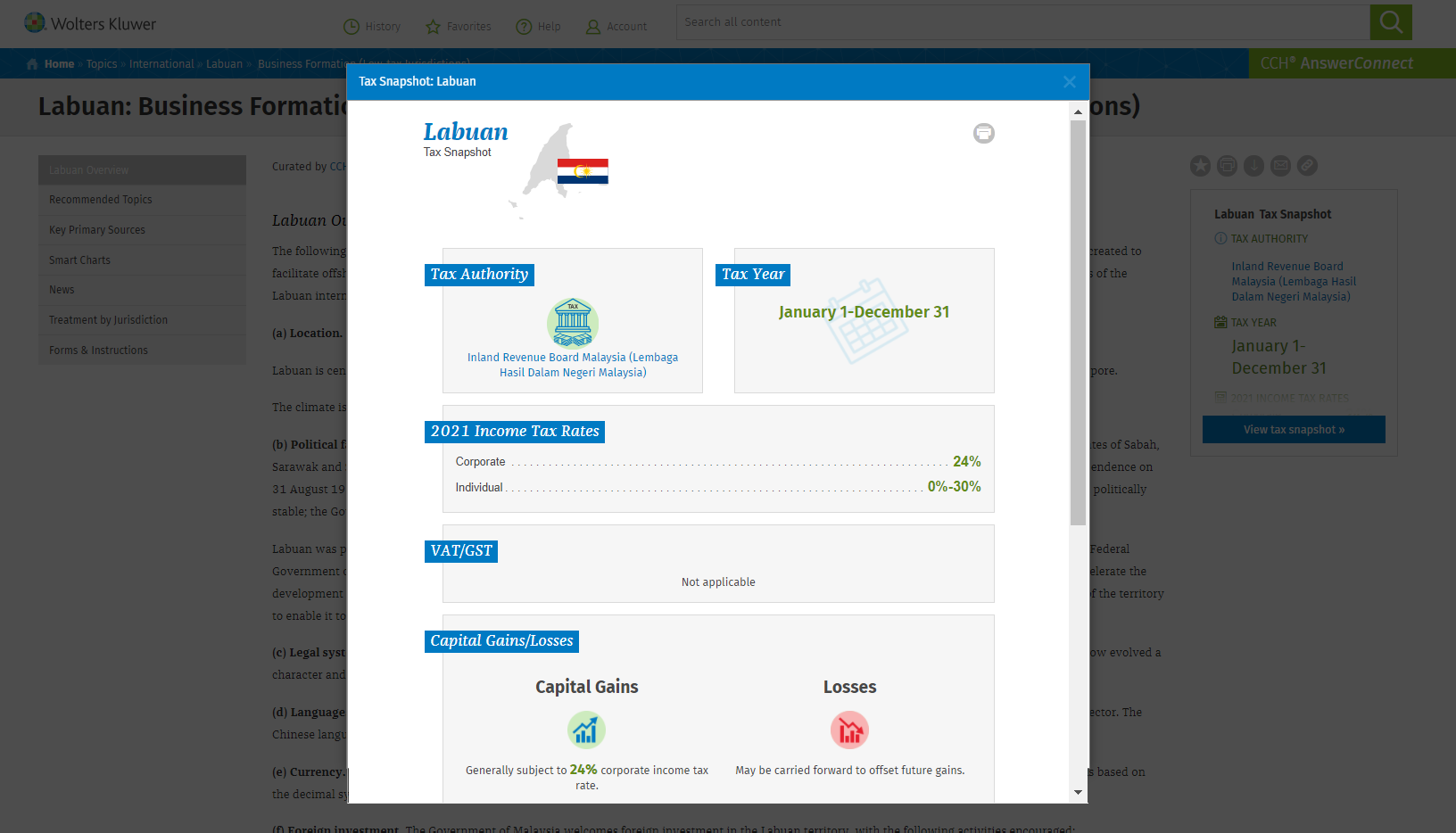

New Low Tax Jurisdiction Topic Pages

We’ve added detailed international tax coverage for an additional 3 low tax countries: Labuan, Madeira, and Nevis. These topic pages include comprehensive, up-to-date information on jurisdictions that offer competitive tax regimes. Detailed coverage includes:

- Business formation

- Corporate income tax

- Banking and exchange controls

- Tax planning

Tools

COMTAX Navigator – Cross-Border Tax Research Solution

Maintain an optimal worldwide tax strategy with the most complete array of cross-border tax analysis and data in the industry.

- Map out detailed scenarios to optimize cross-border transactions with sophisticated modeling, calculation & charting capabilities

- Recommend strategies to route transactions, given the treaty relationships between various countries

- Minimize tax costs & risk

- Automate complex calculations

Combining technology with tax expertise, COMTAX Navigator is a cutting-edge tax control system for multinationals, tax advisors and accounting firms. Access all the international tax resources you need in one place, with CCH AnswerConnect.

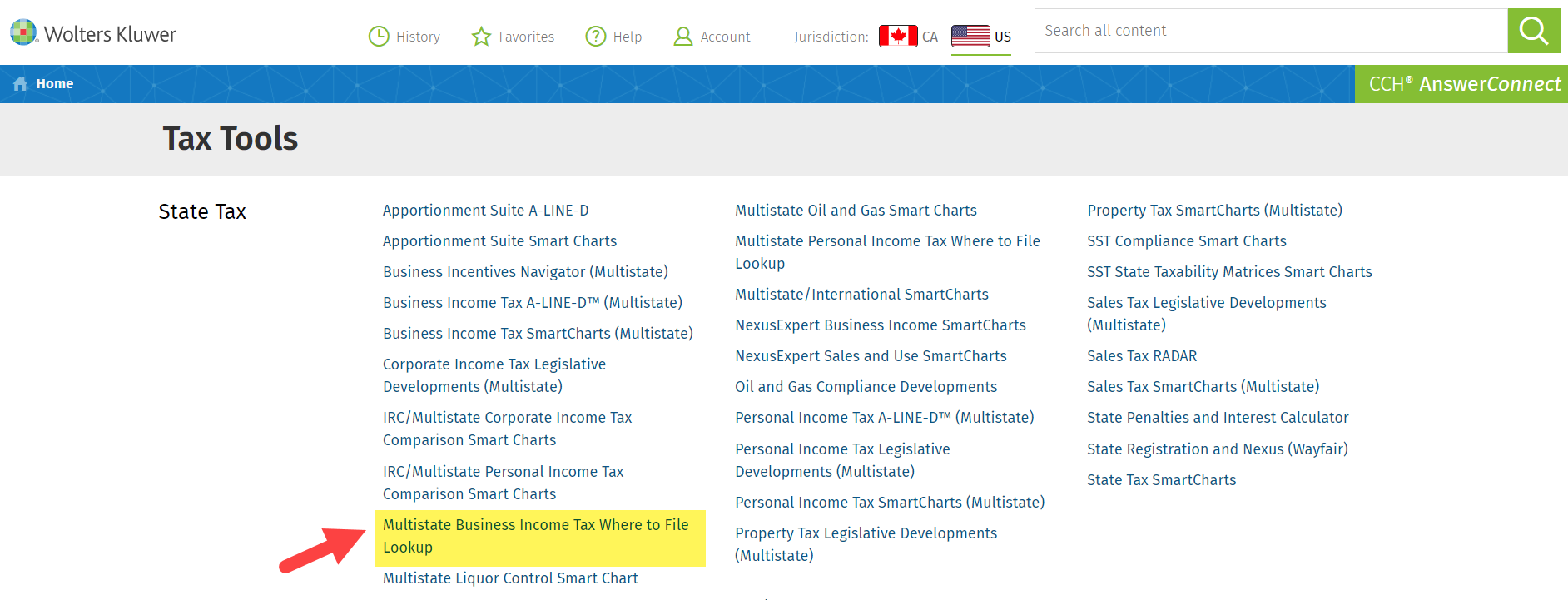

Lookup for Business Income Tax Return Filings

Quickly determine the appropriate filing address for various state business income tax returns that are filed on paper.

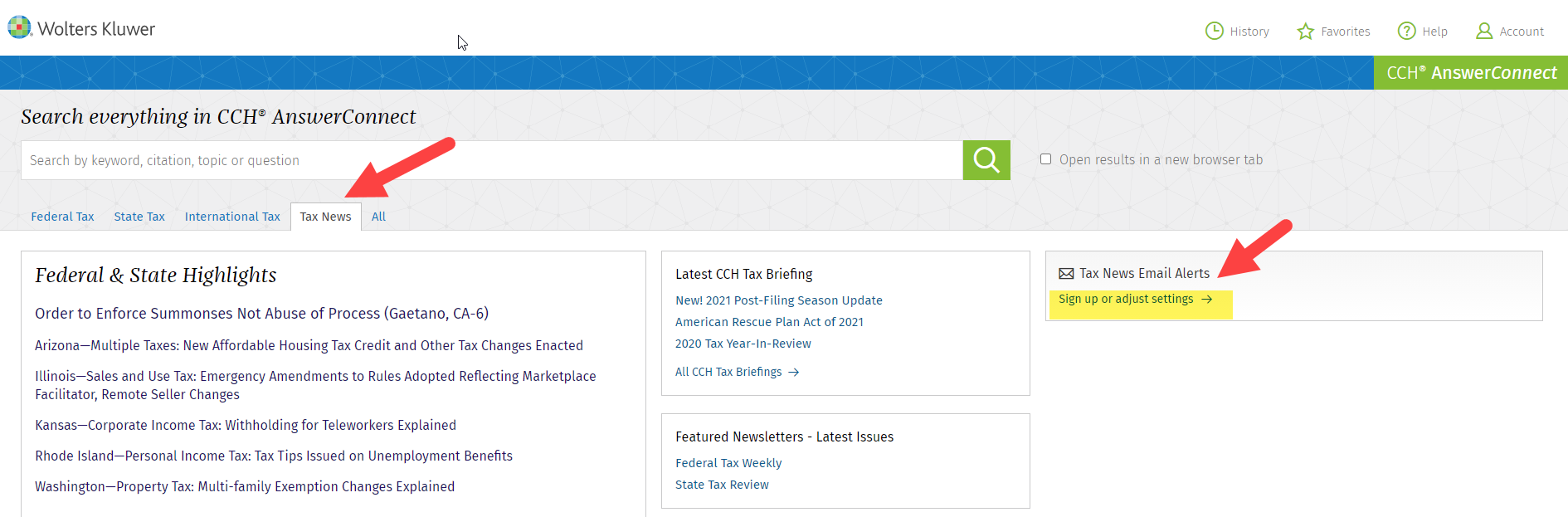

New Email Alerts

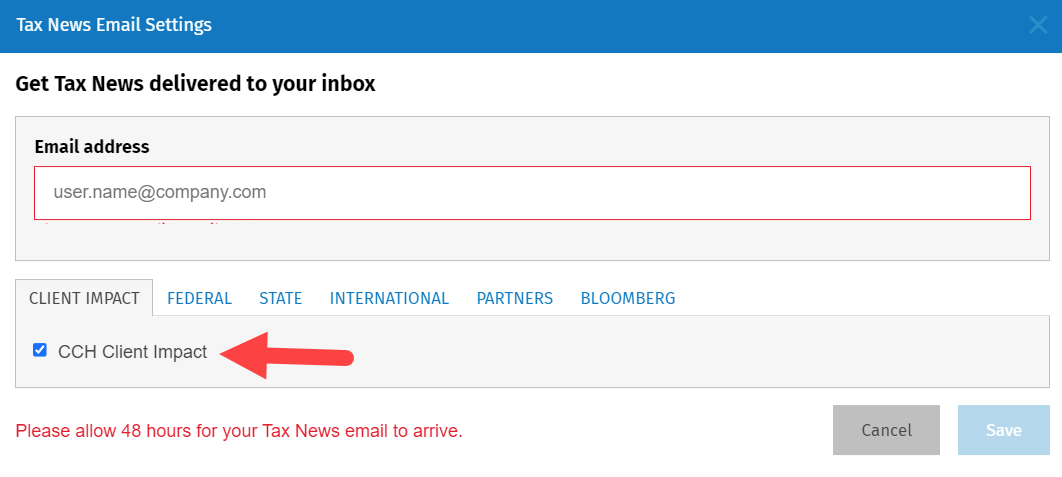

New email alerts can be configured to stay on top of new law and regulatory changes as well as notify you when one of our prestigious Tax Briefings is published on CCH AnswerConnect. You can configure these new alerts by going to the Tax News Home Page and selecting the Sign up or adjust settings link in the Tax News Email Alerts box.

Configuring these settings will enable an email alert for new: Client Impact News events, Tax Briefings, and news articles focused on Oil & Gas tax.

Specialty Libraries

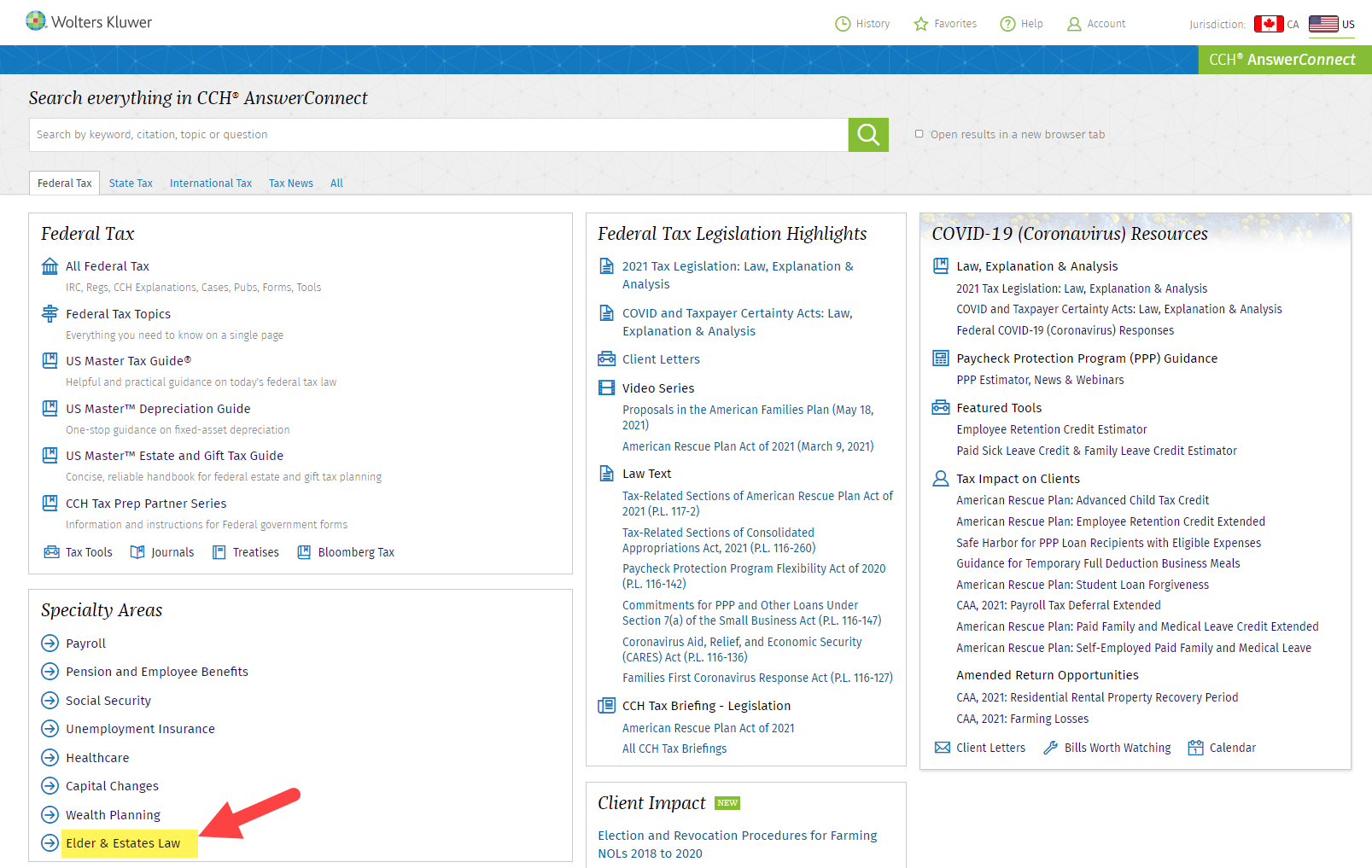

Browse & Search Elder Law

f you subscribe to additional content on Elder & Estates Law, you’ll now be able to link directly to this content on the Cheetah research platform. You can also search for this content right on CCH AnswerConnect.

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.