(Please be aware: you may not see all these updates, depending on your subscription. For more information, please reach out to your sales contact.)

Optimize Your Investment with CCH Axcess™ Document Integration

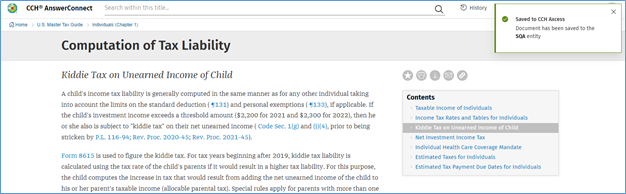

Experience an end-to-end solution with the ability to save tax research to CCH Axcess Document

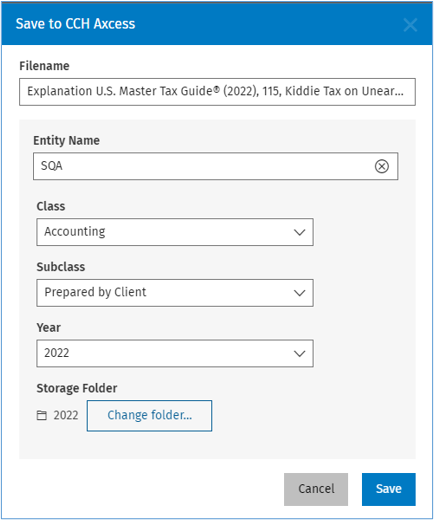

We continue to strengthen integration between CCH Axcess and our expert research content within CCH AnswerConnect. You can save tax research within CCH Axcess Document and organize it for quick retrieval, to plan and relay information back to clients.

To facilitate the review process, add comments and highlight text within tax research and save to CCH Axcess. Reviewers can then easily see junior staff notes and conclusions within research documents that are saved with workpapers.

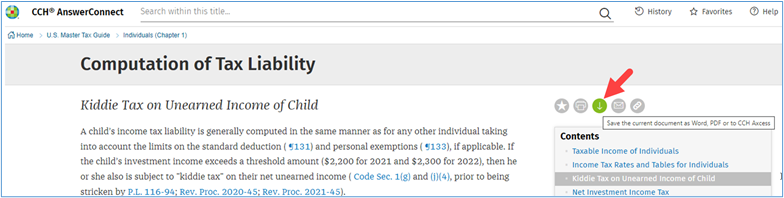

Save any document to CCH Axcess

Select Save to CCH Axcess™

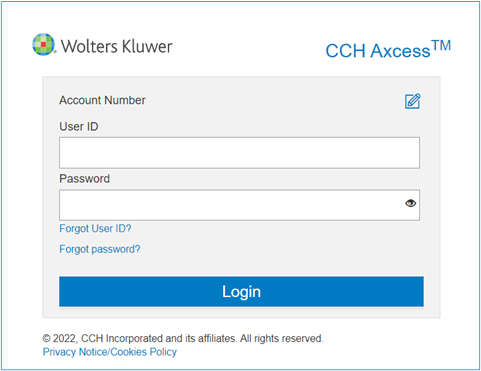

Login to CCH Axcess™

Save to a project or client folder

Confirmation

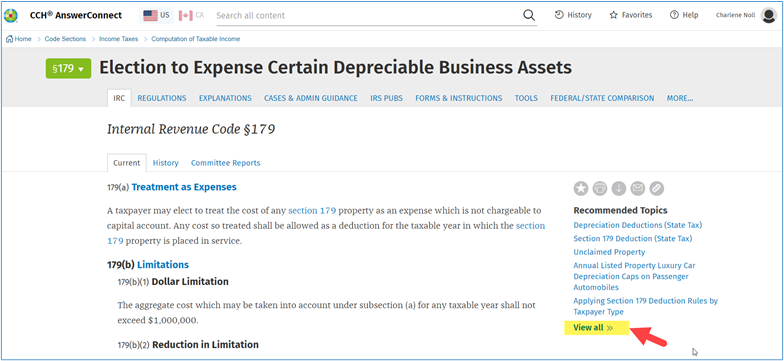

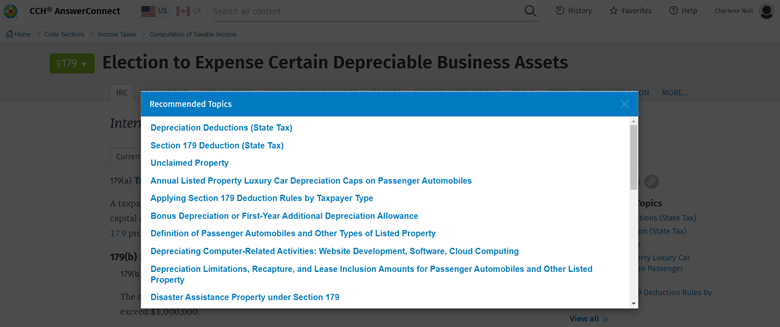

Find additional Recommended Topics in the Code 360° View

View expanded list of Recommended Topics tied to a Code Section

CCH AnswerConnect guides you to on-point information at the point of need. While you’re in a code section, easily jump to a related topic, from our comprehensive list, to find information you need to back up your position or address your client’s question.

See more Recommended Topics from the 360° View

Create Targeted State Tax Email Alerts

Add email alerts for the issues and states that matter most to your practice, using custom search terms. And, if you’re looking for the latest tax incentives across states, you can quickly setup a State Business Credits & Incentives email alert.

Use keywords to create targeted state alerts

Configure alerts for State Business Credits & Incentives

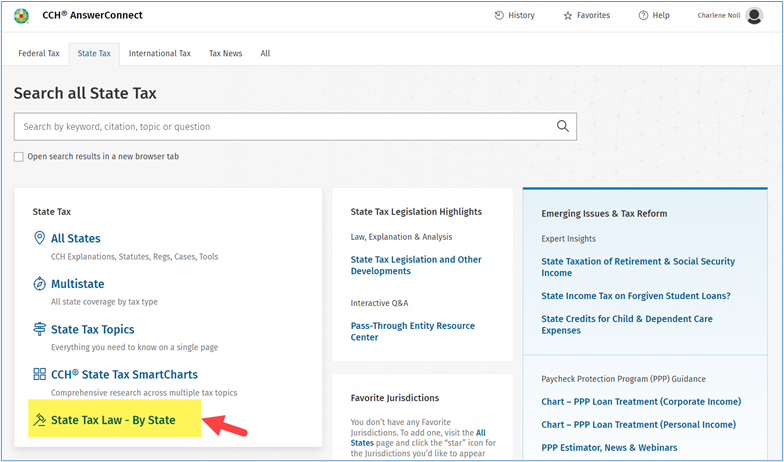

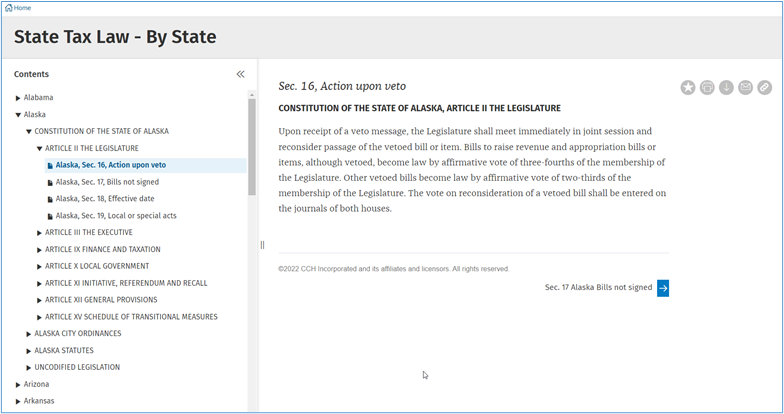

Browse Each State’s Tax Law Framework

You can now browse state tax laws in the state code hierarchical order. Quickly find a specific state tax statutory section or get a general sense of the state’s statutory framework.

Browse state tax laws in hierarchical order

Gauge how experts view International Tax issues, from multiple vantage points

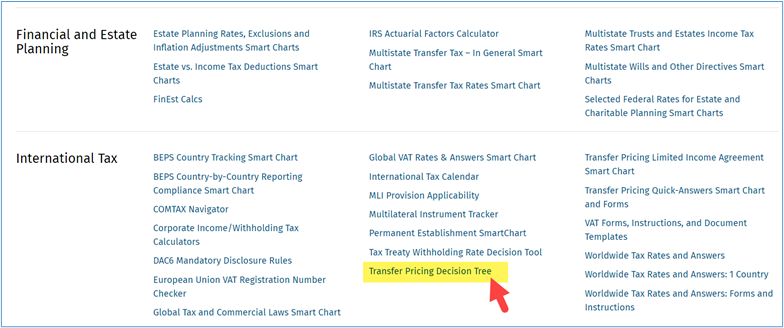

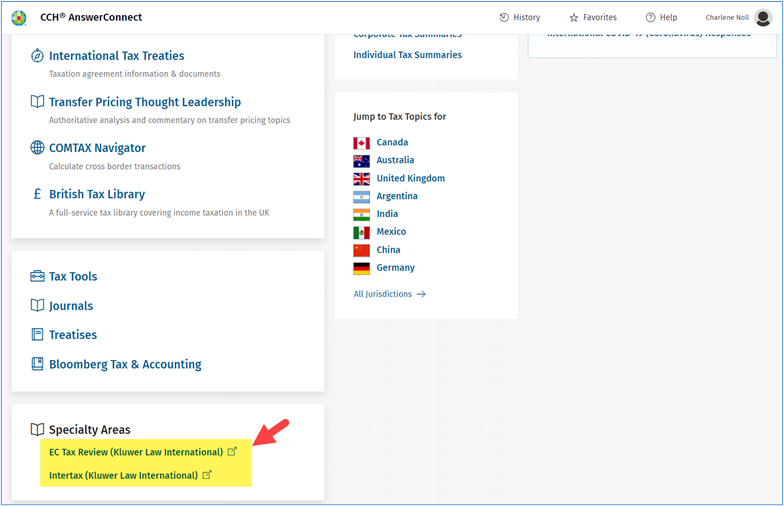

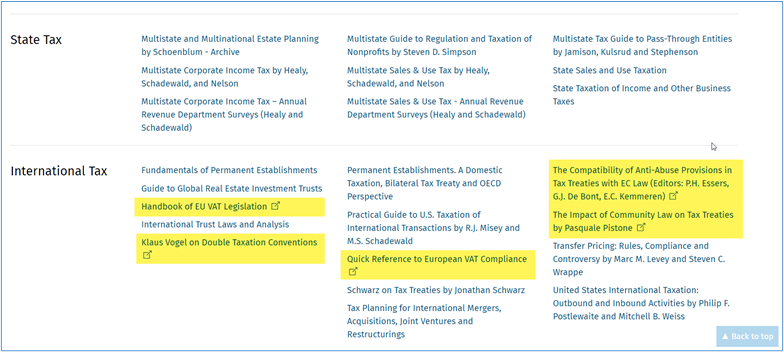

New International Tax Content & Transfer Pricing Decision Tool

CCH AnswerConnect provides comprehensive international coverage including the following new additions:

- Landmark Transfer Pricing Cases

- Transfer Pricing Decision Tree

- Kluwer Law International

- EC Tax Review & Intertax

Treatises

- o Handbook of EU VAT Legislation

- o Klaus Vogel on Double Taxation Conventions

- o Quick Reference to European VAT Compliance

- o The Compatibility of Anti-Abuse Provisions in Tax Treaties with EC Law

- o The Impact of Community Law on Tax Treaties by Pasquale Pistone

Transfer Pricing Landmark Cases available from the International Topics listing

Transfer Pricing Decision Tool

EC Tax Review & Intertax (Kluwer Law International)

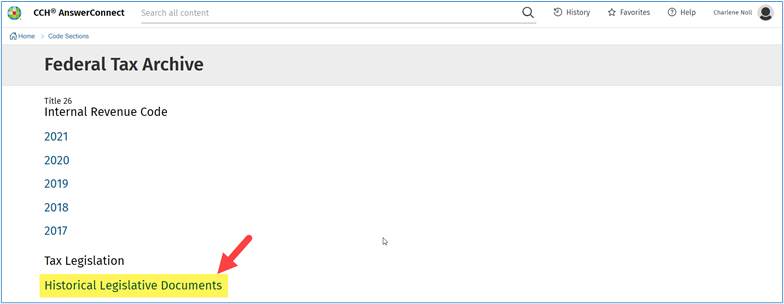

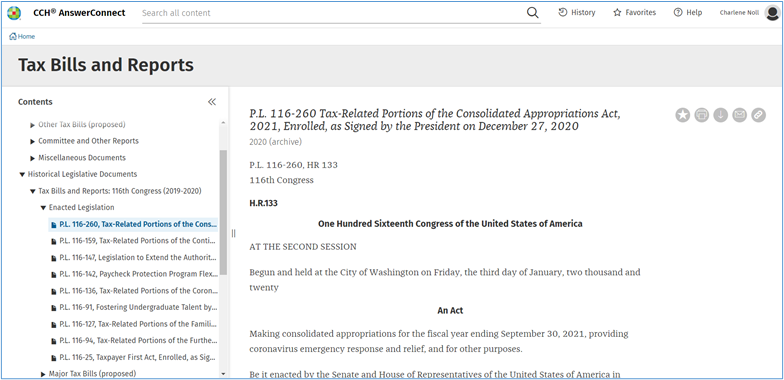

Access Extensive Federal Tax Legislative History

For research on legislative intent, CCH AnswerConnect offers an extensive archive of historical documents encompassing the background and events leading up to the enactment of significant federal tax legislation, including hearings, committee reports and floor debates.

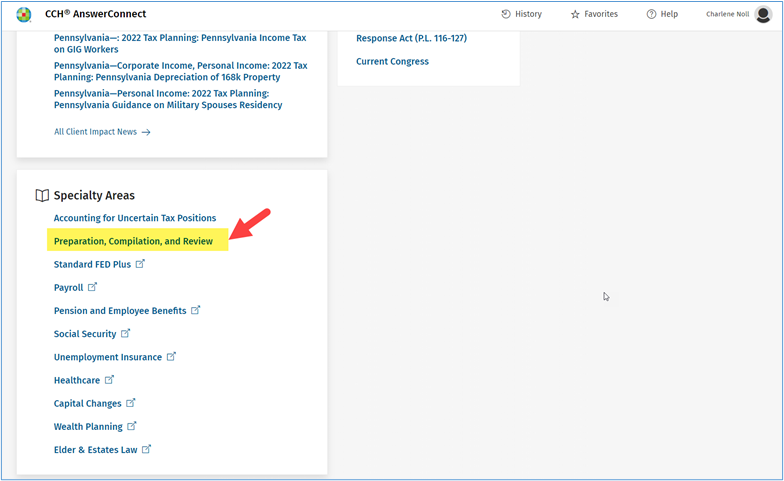

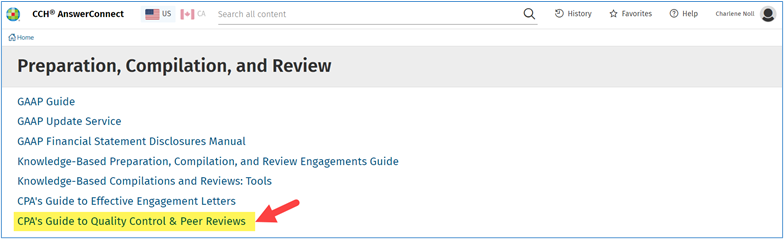

Improve Quality Control for Your Accounting & Auditing Practice

CCH AnswerConnect offers a straightforward and practical reference to help public accounting firms and practitioners design or improve the quality control system for their accounting and auditing practice and conduct an efficient self-assessment. You can find the CPA’s Guide to Quality Control & Peer Reviews on the Federal Tax tab by selecting the Preparation, Compilation, and Review link in the Specialty Areas box.

© CCH Incorporated and its affiliates and licensors. All rights reserved. Subject to Terms & Conditions.